|

CSTC's 2022 SUMMER TAX SYMPOSIUM

June 12-15, 2022

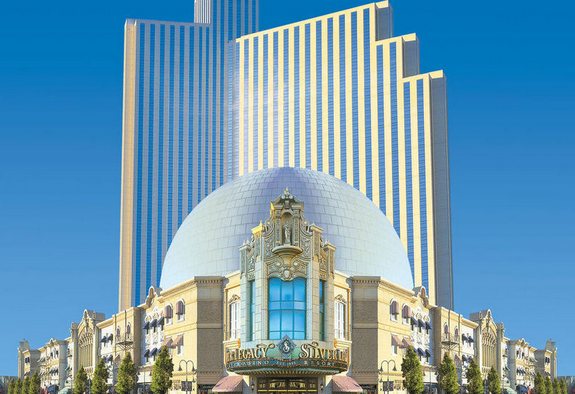

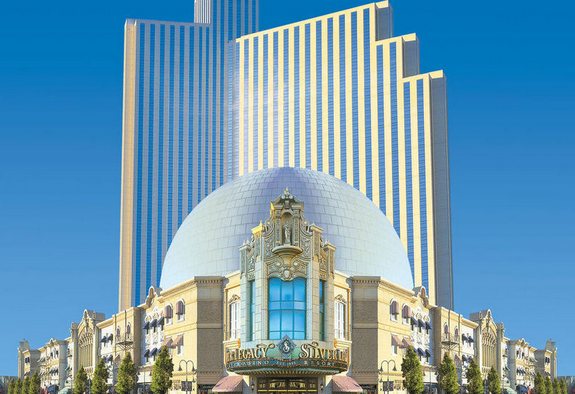

Silver Legacy Resort and Casino

Reno, Nevada

The California Society of Tax Consultants, Inc (CSTC), has been a nonprofit organization for the benefit of tax professionals throughout California since 1966 (formerly known as ISTC), and delivers quality education and unique member benefits. As a bookkeeper, accountant, Enrolled Agent, or CPA, you can take advantage of everything CSTC has to offer. Programs cover a wide spectrum of tax topics that are approved for CTEC, EA & CPA credit.

The CSTC Summer Tax Symposium is an event not to miss!

Quick Links

Thank you to our Sponsors and Exhibitors!

Summer-Symposium Schedule-at-a-Glance

| |

Sunday, June 12, 2022

|

| 3:00 PM - 6:00 PM |

Registration Open; Exhibitor Set-up |

| 5:00 PM to 6:00 PM |

Welcome Reception for First-Time Attendees |

| 6:00 PM to 9:00 PM |

Welcome Dinner

This event is family-friendly.

(Included with full registration. Guest registration is $50)

|

| |

Monday, June 13, 2022

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote Session

IRS Discussion

Speaker: TBA |

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: Getting Back to Basics. A Start to Finish Individual 1040 Review. Without Your Tax Software!

Speaker: Michael Tullio, EA |

| |

Track Two: Current Developments in Federal Estate and Gift Tax and California Trusts and Estates

Speaker: Jennifer Scharre, Attorney at Law

|

| |

Track Three: Anatomy of a No Records Audit

Speaker: LG Brooks, EA, CTRS |

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

(CONTINUED) Track One: Getting Back to Basics. A Start to Finish Individual 1040 Review. Without Your Tax Software!

Speaker: Michael Tullio, EA |

| |

Track Two: Forms of Ownership in California

Speaker: David Eastis, CRTP |

| |

(CONTINUED) Track Three: Anatomy of a No Records Audit

Speaker: LG Brooks, EA, CTRS |

| 12:00 PM to 1:20 PM |

Lunch and Learn

Processes and Procedures

Speaker: Demi Woodson, CRTP |

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: CA Update

Speaker: Claudia Stanley, EA |

| |

Track Two: Cutting Edge Strategies and Reporting for Limited Liability Companies

Speaker: Frank Acuña, Attorney |

| |

Track Three: Data Security for Tax Professionals

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session

Federal Tax Update

Speaker: Jane Ryder, EA, CPA |

| 5:00 PM to 6:30 PM |

Reception with Exhibitors |

| |

Tuesday, June 14, 2022

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote Session

FTB Discussion

Speaker: TBA |

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: Schedule C - Line by Line

Speaker: Chuck Woodson, EA |

| |

Track Two: Retirement Accounts After the SECURE Act

Speaker: Frank Acuña, Attorney at Law

|

| |

Track Three: Practitioner Privilege / POA

Speaker: LG Brooks, EA, CTRS |

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

(CONTINUED) Track One: Schedule C - Line by Line

Speaker: Chuck Woodson, EA |

| |

Track Two: Basics of COD

Speaker: Ryan Reichert, EA, CFP |

| |

(CONTINUED) Track Three: Practitioner Privilege / POA

Speaker: LG Brooks, EA, CTRS |

| 12:00 PM to 1:20 PM |

Lunch and Learn

Engagement Agreements

Speaker: Frank Acuña, Attorney at Law |

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Interest & Dividends - 1040 Schedule B

Speaker: Michael Tullio, EA |

| |

Track Two: CA Update

Speaker: Claudia Stanley, EA, CPA |

| |

Track Three: You CAN Fix the IRS

Speaker: Eva Rosenberg, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session

Business Tax Update

Speaker: Jane Ryder, EA, CPA |

| |

Wednesday, June 15, 2022

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote Session

Tax Stuff you Thought you Knew

Speaker: Ryan Reichert, EA, CFP |

| 9:00 AM to 9:15 AM |

Break with Exhibitors |

| 9:15 AM to 10:05 AM |

(CONTINUED) Keynote Session

Tax Stuff you Thought you Knew

Speaker: Ryan Reichert, EA, CFP |

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Basics of Depreciation

Speaker: Chuck Woodson, EA |

| |

Track Two: Lifecycle of a Non-Profit

Speaker: David Eastis, CRTP |

| |

Track Three: Tax Aspects of Gifting a Home

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP |

| 12:00 PM to 1:20 PM |

Lunch and Learn

Becoming an EA

Speaker: Eva Rosenberg, EA |

| 1:20 PM to 3:00 PM |

General Session

Stump the Tax Experts

Speaker: All speakers are invited to join this panel |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session

Ethics

Speaker: Shannon Hall, EA |

| 5:15 PM |

Grand Prize Drawing |

Registration Information and Fees

| Category |

Fee by March 31, 2022 |

Fee by April 29, 2022 |

Fee After April 29, 2022 |

| Members |

$500 |

$550 |

$600 |

| Staff of Members |

$525 |

$575 |

$625 |

| Non-Members |

$600 |

$650 |

$675 |

| Sunday Social Event Guest Tickets |

$50 |

$50 |

$50 |

Registration fees include: Educational sessions and materials, including a USB thumbdrive of electronic handouts, Daily Breakfasts, Daily Lunches, Sunday Evening Social & Buffet, and Refreshment Breaks.

Optional Printed Handouts: $150 for all session handouts (regardless of attendance) book-style, bound and tabbed, delivered at check-in.

Cancellation policy: Written/emailed requests for a registration fee refund will be accepted until May 20, 2022. A $100 administrative fee will be deducted from all refunds. No refund of any kind will be given if written cancellation notice is received after May 20, 2022. There are no refunds for no-show registrants.

Book Your Room! Book Your Room!

Silver Legacy Resort and Casino

407 North Virginia Street

Reno, Nevada 89501

1-800-687-8733

http://www.silverlegacyreno.com/

Room rate for attendees:

$60 plus tax/fees and a resort fee of $20 per guestroom per night, single or double occupancy starting June 12 through June 16, 2022 or until block sells out.

Room Block Code: CSTC22

About the hotel: Located in the heart of Downtown Reno, The Silver Legacy Resort Casino is a 1,720 room premier destination, boasting every amenity for a perfect getaway: elegant guest rooms and suites, top-name entertainment, six fabulous restaurants, Catch A Rising Star Comedy Club, 85,000 square feet of thrilling gaming space with all of the newest games and 90,000 square feet of state-of-the-art convention space. Guests can also enjoy elegant boutique shopping, an award-winning health spa, the world's largest composite dome and mining rig, Rum Bullions Island Bar - Reno's only rum bar and the ultra hip Drinx Lounge and the upscale Aura Ultra Lounge. Silver Legacy is connected by skywalks to the Eldorado Hotel Casino and Circus Circus Reno providing guests with the largest center for gaming and entertainment in northern Nevada, all just 3 blocks from Reno's Riverwalk and arts district and within minutes of world-class skiing, golfing and more.

The Resort Fee Includes:

- In-room Keurig coffee maker with Starbucks K-Cup Pods

- Unlimited local and toll-free calls

- Two bottles of water, refrigerator and in-room safe

- Airport shuttle service, covered valet and self-parking

- Access to the all-new Fitness Center inside The Spa at Silver Legavy

- Printing of boarding passes, notary services and safety deposit box

Session Descriptions and Presenter Bios

Sunday, June 12, 2022

3 PM - Registration Opens; Exhibitor Set-up

6 PM - 9 PM - Evening Event, “Night at the Movies”

Buffet dinner will begin at 6:30 p.m. This is a family friendly event.

Get to know the Speakers, Vendors, Conference Committee, and other tax professionals!

Monday, June 13, 2022

Session 1: Death and (Income) Taxes Administering an Estate or Trust after Death from a Preparer’s Perspective, Frank Acuña and Ruth Godfrey

Your client has died. Maybe they had a living trust, maybe they didn’t. Their children have asked you to assist with winding up their estate or trust. What do you do? Estate tax is not an issue, but income tax reporting and possibly estate/trust accounting must be done.

This course is taught by an attorney who is a certified specialist in estates and trusts and a very experienced enrolled agent. We will cover the basics (and some advanced topics) of estate and trust administration, final Form 1040, and Form 1041 for administrative trusts and trusts that continue after death. Be ready for lots of examples and pencil-to-paper exercises!

General/Some Hands On

4 Hours Federal Tax Law

Session 2: Trust Fund Recovery Penalty Issues & Case Studies, LG Brooks

Recent developments in enforcement and change in administrative and legal procedure have had a direct affect upon the assessment & application of the provisions of the “Trust Fund Recovery Penalty” (TFRP). Enforcement and application of criminal elements have been heightened and the IRS has elevated the pursuit of this matter by issuing the dreaded “Letter 903” in addition to the TFRP dilemma.

This presentation is designed to explore, discuss & expose the critical elements of the potential assessment of the TFRP. During this course we will also participate in the development of appropriate defenses of & legal arguments to the proposed assessment of the TFRP through “interactive” and “hands-on” case studies. All case studies will be based upon actual Tax Court & District Court decisions & IRS published determinations.

Intermediate/Advanced

3 Hours Federal Tax Law

1 Hour Federal Tax Law Update

Session 3: Business Basics, Claudia Stanley

This is a beginner course designed for those who want to start preparing business returns—Schedule C, Partnerships, Corporations, LLCs. What’s deductible, what forms are required, and when to enlist the help of another professional. The biggest emphasis will be on Schedule C’s, but we will introduce and discuss entity basics, differences, and the pitfalls.

Basic/General

3 Hours Federal Tax Law

1 Hour CA State Law

Session 4: Tax Court Case Reviews, LG Brooks

It has been noticed that many Tax Practitioners, Tax Representatives as well as Tax Preparers operate under the pretense that since they are not actually an Attorney or a Tax Court Practitioner that their judicial awareness of the decisions of the United States Tax Court (Court) is not necessary. However, every practitioner, representative and preparer is affected by the decisions of this Court. Additionally, any EA’s and/or CPA’s that represents any taxpayer before the IRS may eventually assist their client in this Court and should be prepared to facilitate the “pro se” taxpayer’s presentation of their tax matters.

This presentation is designed to explore, discuss & explain the most recent & most pertinent Tax Court Cases that affect the practitioner community and also demonstrate how to effectively interpret the decisions of the Court to enhance your tax practice.

Intermediate/Advanced

2 Hours Federal Tax Law

Session 5: IRA Rules Every Tax Professional Must Know! Frank Acuña

Tax professionals are called on to advise clients about more than taxes. What are the options when designating retirement account beneficiaries? Are there optimum strategies to reduce taxes during retirement and for the next generation? Is there any way to control a beneficiary’s use of an IRA?

This course examines cutting edge tax reduction strategies for retirement accounts, and common beneficiary designations and which ones to avoid. The rules concerning required distributions will be explained, as will recent changes, which permit IRA Conduit Trusts (and why they are absolutely necessary for asset protection).

General/Some Hands On

2 Hours Federal Tax Law

Session 6: Schedule A: What is Left, What Does California Say? Eugene Ostermiller

Schedule A: With the passage of tax reform in December, the Schedule A has been totally rewritten. What is Left, What Does California Say? In this 2-hour session, we will review the Schedule A changes and then discuss what California will do in response to all of the new differences.

General

1 Hour Federal Tax Law

1 California State Hour

Session 7: Tax Services & Legalized Cannabis, Claudia Stanley

This course will cover how to legally and ethically provide tax services to the marijuana industry: What’s deductible, what’s not; Pitfalls of a cash industry; Understanding 280E; Filing 8300; Inventory tracking; What activities are trafficking and which ones are not; Understanding what constitutes money laundering; and, What are the risks for professional advisors?

General/Intermediate

3 Hours Federal Tax Law

1 Hour CA State Law

Session 8: Filing Status – It’s Not Always Straightforward and Easy to Choose, George Van Buren:

One of the first things practitioners learn in the tax business is the different statuses available to taxpayers. Choosing the correct filing status is extremely important. The amount a taxpayer ultimately has to pay the IRS rests in large part on the filing status, Once it has been determined that the taxpayer has a filing requirement, the next thing is to decide their correct filing status. That may sounds simple, however, it can be quite confusing. Why, would something so simple be confusing? The reason lies in our complex tax code with sometimes violates not only logic, but also common sense. For, example, we have a tax system where a “qualifying relative” doesn’t have to be have to be related to you and where a taxpayer who is married can be considered “unmarried” for tax purposes. Now throw into the mix the various rules regarding same-sex marriage it’s made even more difficult. This seminar will include an in-depth look at the different filing statuses and how they are determined with particular emphasis on Head of Household (HOH). We will also discuss some of the non-traditional families and how the filing status affects them.

General

2 Hours Federal Tax Law

Session 9: Cyber Security, Ruth Godfrey

Do you invite intruders into your office? Do you check “Later” when your software gives you the option about an upgrade? Do you know where your employees are “going?” Are your employees on your side? Do you know the Cloud can open up and drop you through? What are the newest threats to our peace of mind? Spend two hours learning how to protect your office, computers, and you!

General

2 Hours Federal Tax Law

Session 10: California Update: How do the federal changes impact California? Eugene Ostermiller

California Update: How do the federal changes impact California? We will review this in depth in addition to other things California has in store for professional tax preparers.

General

2 Hours California State Law

Session 11: Keynote Presentation: Data Breaches and Business Email Compromises, Forrest Knorr

It is almost impossible to be in the return preparation business and not collect or hold personally identifying information — names and addresses, Social Security numbers, etc., about your clients and employees. If this information is lost or stolen, it could put these individuals at risk for identity theft. However, not all compromises of personal information result in identity theft. The type of personal information compromised can significantly affect the degree of potential damage. In this seminar, you will increase your understanding identity and data theft scams, and the impact on you and your clients. The learning objectives of this presentation are to increase awareness about data loss thefts, where information ends up if lost or stolen, how to protect taxpayer information and actions to take when compromised.

General

1 Hour Federal Tax Law

Tuesday, June 14, 2022

Session 12: OICs from A’s to Z’s, LG Brooks and Beanna Whitlock

The rules, regulations, and internal guidelines pertaining to the filing of an “Offer-in-Compromise” have changed significantly for all taxpayers (individuals and businesses). Strict adherence to these new rules and guidelines is critical with respect to the ultimate acceptance of the taxpayers’ request. Therefore, knowing what to expect from the IRS Offer Division and more importantly how to properly respond are pertinent elements of presenting a successful case.

General/Hands-on

2 Hours Federal Tax Law

1 Hours Federal Tax Law Update

1 Hour CA State Law

Session 13: 4797 Line by Line, Eugene Ostermiller

4797 Line by Line: In this four hour federal tax law session, we will be discussing sections 1231, 1245, 1250 property assets. As well, we will do a problem line by line in class to go through the form 4797 together to see how it works. Please bring pencils and a calculator for this session.

Hands On

4 Hours Federal Tax Law

Session 14: Casualties & Disasters, Claudia Stanley

This course will cover assisting taxpayers who experience a casualty or are in a disaster area. Instruction will cover the fundamentals of claiming losses (or gains) related to these events. We’ll also look at what to do when records are destroyed. This course will include the recent Disaster Tax Act and changes to claiming losses made by the Tax Cuts and Jobs Act.

General

3 Hours Federal Tax Law

1 Hour CA State Law

Session 15: Schedule C– Real Businesses and Fake Businesses, George Van Buren

If taxpayers engages in a business with the objective of making a profit, they can generally claim all their proper business deductions. If the taxpayer’s business deductions exceed their income for the ta year, they can claim a loss for the year, up to the amount of the taxable income from other activities. Any remaining losses may be carried over into other year. Unfortunately, may taxpayers are filing Schedule Cs for fake businesses just to use losses against legitimate income.

However, if the IRS deems the business to have no profit motive (an activity not engage in for profit) the ability to deduct losses is limited to the amount of income generated by the activity. These are the “Hobby Loss Rules” under IRC 183. A “hobby” cannot generate a tax loss that can be used to offset other taxable income on your tax return. Losses incurred by individuals, partnerships and S corporations in connection with a hobby are generally deductible only to the extent of the income produced by the hobby.

The Treasury Inspector General for Tax Administration (TIGTA) said in a recent report that many schedule C filers engage in tax abuse or “fake” businesses by reporting significant hobby losses to offset regular income. TIGTA also said in their report that 73% of these returns were filed by professional ta practitioners.

This seminar will include not only a discussion of the above information, but also a review of the nine (9) points the IRS will look at if they suspect an activity is not engaged in for profit. We will also discuss various audit flags the taxpayer should be aware of and review some key court cases in this area.

Intermediate

4 Hours Federal Tax Law

Session 16: The Notice of Deficiency & IRS AJAC, LG Brooks

The issuance of a “Notice of Deficiency” (Stat Notice) entitles a taxpayer to certain “judicial rights” with respect to pursuing further administrative remedies and/or a potential litigation resolution. However, due to the implementation of the “Appeals Judicial Approach Cultural” (AJAC) initiative, a significant number of State Notice’s are expected to be issued, which will force the taxpayer into litigation or force the taxpayer to forfeit their right to resolution.

This presentation is designed to discuss & explain the legal guidelines, requirements & critical effect related to the issuance of the “Notice of Deficiency” as well as the adverse implications of the AJAC initiative as it relates to the legal/judicial parameters of the Notice of Deficiency.

Intermediate/Advanced

2 Hours Federal Tax Law

Session 17: What to Do With A/B Trusts That No Longer Make Sense, Frank Acuña

This session examines subtrust funding requirements when a first spouse has died and the unusual situations in which tax professionals and fiduciaries find themselves. Pencil-to-paper problems funding subtrusts in compliance with IRS requirements will be examined. Continuing reporting requirements on 1041s and 706s will be discussed. Finally, the pitfalls and litigation issues that arise during trust administration will be discussed. In this session you will learn:

• Subtrust funding requirements (bypass trusts, QTIP trusts, etc.);

• How to recognize common problems and how to avoid or eliminate them; and,

• How to Identify (and avoid) disputes between beneficiaries and trust litigation?

General/Some Hands On

2 Hours Federal Tax Law

Session 18: Gifts, Estates, and Trusts, Beanna Whitlock

During Gifts, Estates, and Trusts, a two-hour, intermediate session, attendees will learn about Forms 709 and 706 and the requirements of filing with update of new tax legislation. Attendees will also learn about the issues of portability, valuations, and other critical information. Form 1041 will be discussed, "Who Do You Trust."

Intermediate

2 Hours Federal Tax Law

Session 19: Non-Residents, Eugene Ostermiller

Non-Residents: When do you file a 1040 or 1040NR? What is a dual status return or a dual status statement? In this intermediate, two hour federal tax law session, we will review the basics of how to prepare a United States Return for non-citizens.

Intermediate

2 Hours Federal Tax Law

Session 20: California Update: How do the federal changes impact California? Eugene Ostermiller

California Update: How do the federal changes impact California? We will review this in depth in addition to other things California has in store for professional tax preparers.

General

2 California State Hours

Session 21: THOSE WONDERFUL K-1s, Ruth Godfrey

Is your client an investor? Does he own a business entity? Did someone place money in a trust for your client? Did someone die and leave your client an estate? Where does all that information go on my client’s return? The K-1 shows big losses – so I’ll just wash out my client’s AGI and he won’t owe any taxes – right? Basis – what does that have to do with anything? Am I supposed to know whether the K-1 came from a partnership, LLC, S Corporation, Estate or Trust? We will discuss the main parameters of reporting information sent to your client on a K-1 – how much of it do you use? Where do you report it?

Intermediate

2 Hours Federal Tax Law

Session 22: Decedents Final 1040 and 1041, Beanna Whitlock

During this intermediate, two-hour federal tax law session, tax professionals will be exposed by case study to the requirements of filing final form 1040 and when the estate will begin with the requirements of filing. Practitioners will also learn about distributable net income and allocations for the beneficiaries of estates.

Intermediate

2 Hours Federal Tax Law

Session 23: Schedule E – Doesn’t Stand for Easy – Rental Real Estate and Vacation Homes, George Van Buren

Many taxpayers own second houses or apartments that they rent out all the time. Others own vacation homes they rent out when their family isn’t using it. In most cases all rental income must be reported on the taxpayer’s tax return, but there are differences in the expenses taxpayers are allowed to deduct and the way the rental activity is reported on the tax return. This seminar will cover the the following: (1) the rental-for-profit activity in which there is no personal use of the property; (2) depreciation as it applies to rental real estate; (3) the reporting of rental income and deductions including casualties and thefts; (4) special rental situations including cooperatives, property changed to rental use, renting only part of the taxpayer’s property, and a not-for-profit rental activity; and (5) the rules for rental income and expenses when there is also personal use of the property, such as a vacation home.

Intermediate

2 Hours Federal Tax Law

Wednesday, June 15, 2022

Session 24: 2018 Tax Cuts & Jobs Act, Beanna Whitlock

During this four-hour federal tax law update session, the presenter will review the Tax Cuts and Jobs Act (ICJA), the largest piece of passing tax legislation in recent history. Individuals, businesses, and foreign issues-- the presenter will review and do a comparison of provisions to inform tax professionals of the changes.

General to Advanced

4 Hours Federal Tax Law Update

Session 25: Tax Experts Panel, All Presenters

This is a special question and answer session with our unique panel of Tax Experts that includes all our terrific speakers who have agreed to let us test their tax knowledge! Do you have a burning question that is driving you crazy because you cannot find the answer on your own? Did you learn something in one of your classes that needs further explanation for you to understand the tax concept? Questions will only be taken from the floor if time permits.

Intermediate

2 Hours Federal Tax Law

Session 26: Ethics: Where Do You Keep Your Ethics, Beanna Whitlock

During this two-hour, ethics hours session, the presenter will review the rules of ethical conduct for tax professionals and will use Treasury Department Circular No. 230 as a guide. Attendees will also be given scenarios and examples as evidence that even the most ethical of tax preparers can be compromised.

2 Hours Ethics

About the Presenters

Frank Acuña, Attorney at Law Frank Acuña, Attorney at Law

Frank R. Acuña is a founding partner of ACUÑA ❖ REGLI. He is a California State Bar certified estate planning, trust, and probate law specialist. His practice includes estate planning; inheritance litigation; business succession planning; special needs trusts; and farm, ranch, and vineyard succession planning. Mr. Acuña has taught tax seminars for the National Tax Practice Institute, the California Society of Enrolled Agents, the California Society of Tax Consultants, a number of state and local chapters of the National Association of Enrolled Agents, and the American Institute of Certified Public Accounts. Mr. Acuña also is a featured speaker for the Professional Fiduciary Association of California, the National Guardianship Association, and the California Public Administrators, Public Conservators, and Public Guardians. He advises tax, fiduciary, and real estate professionals throughout the State of California.

LG Brooks, EA, CTRS LG Brooks, EA, CTRS

LG Brooks is an Enrolled Agent and is the former Senior Consultant of The Tax Practice, Inc., located in Dallas Texas. However, LG is now the Senior Tax Resolution Consultant with Lawler & Witkowski, CPAs and EAs which is headquartered in Buffalo, NY. LG has been in the field of taxation for more than 25 years and has been in practice full time since 1990. LG’s areas of practice include Tax Representation and Pre-Tax-Court Litigation Support Services. LG continues to provide tax presentations for numerous tax and accounting societies and has made presentations at several Internal Revenue Service (IRS) Annual Tax Forums. LG received a Bachelor of Arts degree from Bishop College at Dallas, Texas in 1977 and is a Fellow of the National Tax Practice Institute (NTPI). He is currently a faculty member of the National Tax Practice Institute (NTPI) and he is extremely proud and honored to be an Enrolled Agent.

David Eastis, CRTP David Eastis, CRTP

David A Eastis, CRTP, received his Bachelor- of Arts Degree from the University of La Verne in 1980, and Master of Arts in Theology Degree from Bethany Seminary in 1984. He completed his accounting degree in 2003 from Indiana University, South Bend, Indiana.

David joined the California Society of Tax Consultants in 2004. David has served as Secretary for the Greater- Long Beach Chapter, a 4-year- term as Secretary, a one-year term as 1st Vice President. and a two-year term as President of CSTC Society Board for 2015-2016. Currently, David serves as a Society Board Director- for Region Three.

David has been encouraged by CSTC to share his gifts of speaking and teaching as a presenter- for various chapter- meetings. the CSTC Summer Symposium, and the Fall Symposium. His topics have included: Non-Profits Form 990; S Corporations; Preachers, Teachers, and other Tax Creatures (specialized vocational Fields}; Charitable Contributions; Reading Schedule K-1s; and Ethics. And in the Fall of 2019, David has completed his eighth year teaching the Fundamentals Tax Course (Contact) for CSTC. David lives with his wife, Ann, and their dog Archie, in La Habra California.

Shannon Hall, EA Shannon Hall, EA

Shannon Hall spent three years studying classical theatre at an acting conservatory, so it was only a matter of time before she got into the tax business. She has been a member of CSTC since she began preparing taxes all the way back in 2012, though her tax career truly began many years before when, as a child, she would play with the tax forms in the library. Shannon has prepared taxes at respected places like her kitchen table and H&R Block, where she served as an instructor and office manager before moving in with some laid back CPAs in Signal Hill, CA. More than anything, Shannon hopes to make tax education engaging and fun and strives to make taxes less taxing. Shannon is a proud member of the Greater Long Beach Chapter of CSTC and is happy to serve on the Board of Directors.

Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP

Mr. Pon is a Certified Public Accountant, Personal Financial Specialist, Certified Financial Planner, Enrolled Agent, United States Tax Court Practitioner, and Accredited Estate Planner in Redwood Shores, CA.

Mr. Pon has been in practice since 1986 and enjoys helping his clients reach their financial goals. He frequently speaks on tax and financial planning topics.

Mr. Pon received his BS in Business Administration with emphases in Accounting and Finance from the University of California, Berkeley and MS in Taxation from Golden Gate University in San Francisco.

Ryan Reichert, EA, CFP

Ryan's background in tax preparation, business, financial planning, and tax research make him especially equipped to tackle the interpretation of new tax legislation. He will cover the California conformity (or nonconformity) to this year’s new tax laws and let you know when a CA adjustment is needed and how to make it. His “CA Adjustments” desktop reference card will be a valuable resource for you next tax season.

Eva Rosenberg, EA

From the age of 10, Eva always wanted to grow up to be an author. But, when it came time for college, she did the practical thing – studied accounting to ensure a steady living. This turned out to be a lot more interesting than expected. Though, when it came to tax classes, Eva felt those were a total waste of time.

Why? The instructors devoted all the precious time to teaching things that always changed – like the exemption amounts, standard deductions, and other things that were printed directly on each year’s forms. They never taught anything useful, like how to use the tax code to pay the least amount of taxes. Since tax law changes every year, this just seemed like too much trouble to learn. Tax was definitely not the field for Eva!

Somehow, during the course of studying for her MBA in International Business, Eva got sidetracked. She accepted a job in the tax department at a national CPA firm. It got merged into Ernst & Ernst. The job was just for a little while, then Eva would move on to her passion, International Marketing. That was over 30 years ago – and she’s still doing taxes

Jane Ryder, EA, CPA

Jane Ryder, EA, CPA has been providing tax preparation, accounting services, and tax collection resolution services since 1980. She runs her San Diego CPA firm and writes and speaks on many income tax, business compliance and accounting topics. Jane has a business centric practice, preparing and consulting on tax, accounting, and compliance matters for Corporations, S-corporations, LLC’s, Partnerships, and Trusts. She also specializes in IRS and state agencies collection problems, payment plans, audit representation, audit appeals, offers in compromise, and other compliance related issues. She earned a BS in Business Administration (Accounting) from SDSU and is currently licensed with the California State Board of Accountancy and admitted to practice before the the Internal Revenue Service as an Enrolled Agent.

Jennifer Scharre, Attorney Jennifer Scharre, Attorney

Jennifer F. Scharre is a Partner with Temmerman, Cilley & Kohlmann, LLP in San Jose, California. Mrs. Scharre's practice includes estate planning, wealth transfer planning, estate administration, beneficiary representations, conservatorship matters and guardianship matters.

Her estate planning practice includes the preparation of revocable trusts, irrevocable trusts, and wills, as well as incapacity planning documents. Mrs. Scharre's trust and decedent's estate administration practice includes representation of trustees, personal representatives, and beneficiaries in all aspects of trust administration and probate including preparation of trust accountings and estate tax returns.

Mrs. Scharre's Accounting degree from the University of San Diego makes her uniquely equipped to assist clients in complex estate planning and estate administration. Ms. Scharre earned her J.D. degree from Santa Clara University School of Law.

Claudia Stanley, CPA, EA Claudia Stanley, CPA, EA

Claudia Stanley, CPA is a graduate of California State University, Fresno, and serves as treasurer of the California Society of Tax Consultants, as education chair of the Central California Chapter of Enrolled Agents, and as treasurer of Fresno’s local chapter of American Business Women’s Association. Claudia is a long-time member of CSTC. In 2016 she was named member of the year of the Central Valley Chapter of CSTC and in 2001 she was named one of the Top Ten Women of the Year in the nation by the American Business Women’s Association. She frequently speaks on various tax topics.

Michael Tullio, EA Michael Tullio, EA

Mike is an Enrolled Agent and has been in the tax preparation business for nearly 40 years. He is the owner of Michael A. Tullio Financial Services, located on Mission Gorge Road in San Diego California. Mike up until recently was a Senior Tax Content Analyst at Intuit, makers of Turbo Tax, ProSeries and Lacerte. He is an Enrolled Agent. He is a member of the National Society of Tax Preparers (NSTP) and a member of the California Society Tax Consultants (CSTC).

Chuck Woodson, EA

Chuck Woodson, EA has been preparing tax returns professionally since 1976. He also teaches tax preparation techniques to other preparers. As an Enrolled Agent (EA), he is appointed to represent taxpayers before the IRS and provides audit representation and compliance resolution with both the IRS and Franchise Tax Board.

Demara Woodson, CRTP

Demi Woodson is a Coach and Practice Management expert with Horizon Planning Tax & Bookkeeping Services. She has spent over 30 years working with her parents; operating and growing their family’s 45-year-old successful tax business.

Demi created the Tax Preparer Support Group - a private community of like-minded tax professionals seeking and offering support to others in the industry. Her passion is providing quality support and education to tax professionals. Her hands-on approach to moderating the group keeps the nurturing culture she has worked to create.

Working with thousands of tax professionals in her group, Demi recognized there was a serious deficit in the education of tax preparers. While technical training was readily available, there was scarcely any education on operating and growing a successful tax practice.

In 2019, Demi launched Beyond 415 Tax Coaching. In this advanced program, she teaches tax professionals how to build, grow and scale their business through operations and strategies to create a successful tax practice.

More recently, Demi created the Beyond 415 National Tax Summit. This multi-day educational event designed for tax professionals combines the most requested topics in tax law, business development and tools to explode their business. This one-of-a-kind tax conference is held annually in multiple states throughout the country.

The Symposium presentations have been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

|

LG Brooks, EA, CTRS

LG Brooks, EA, CTRS David Eastis, CRTP

David Eastis, CRTP Shannon Hall, EA

Shannon Hall, EA Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP

Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP

Jennifer Scharre, Attorney

Jennifer Scharre, Attorney Claudia Stanley, CPA, EA

Claudia Stanley, CPA, EA Michael Tullio, EA

Michael Tullio, EA