- Home

- Membership

- Education

- Chapters

- News

- Member Resources

- Events

- Find a Tax Preparer/Consultant

FAQsEDUCATIONAL OPPORTUNITIESCSTC has 15 chapters statewide, ensuring that educational opportunities are available every month. Chapters host both in-person and virtual meetings, providing members with flexible options to learn and connect. Our chapters offer:

Larger programs by CSTC include:

REPORTING VIRTUAL CONTINUING EDUCATIONAttendees who completed the minimum polling requirements will be emailed the Certificate of Completion within five business days of the chapter meeting, and the hours will be reported to the IRS and CTEC.

Your hours are reported before the Certificate of Completion is emailed to all registrants.

When you receive your Certificate of Completion, please note that some sections will already be filled in (such as the date, course title, and CTEC course number). You will need to fill in your own information

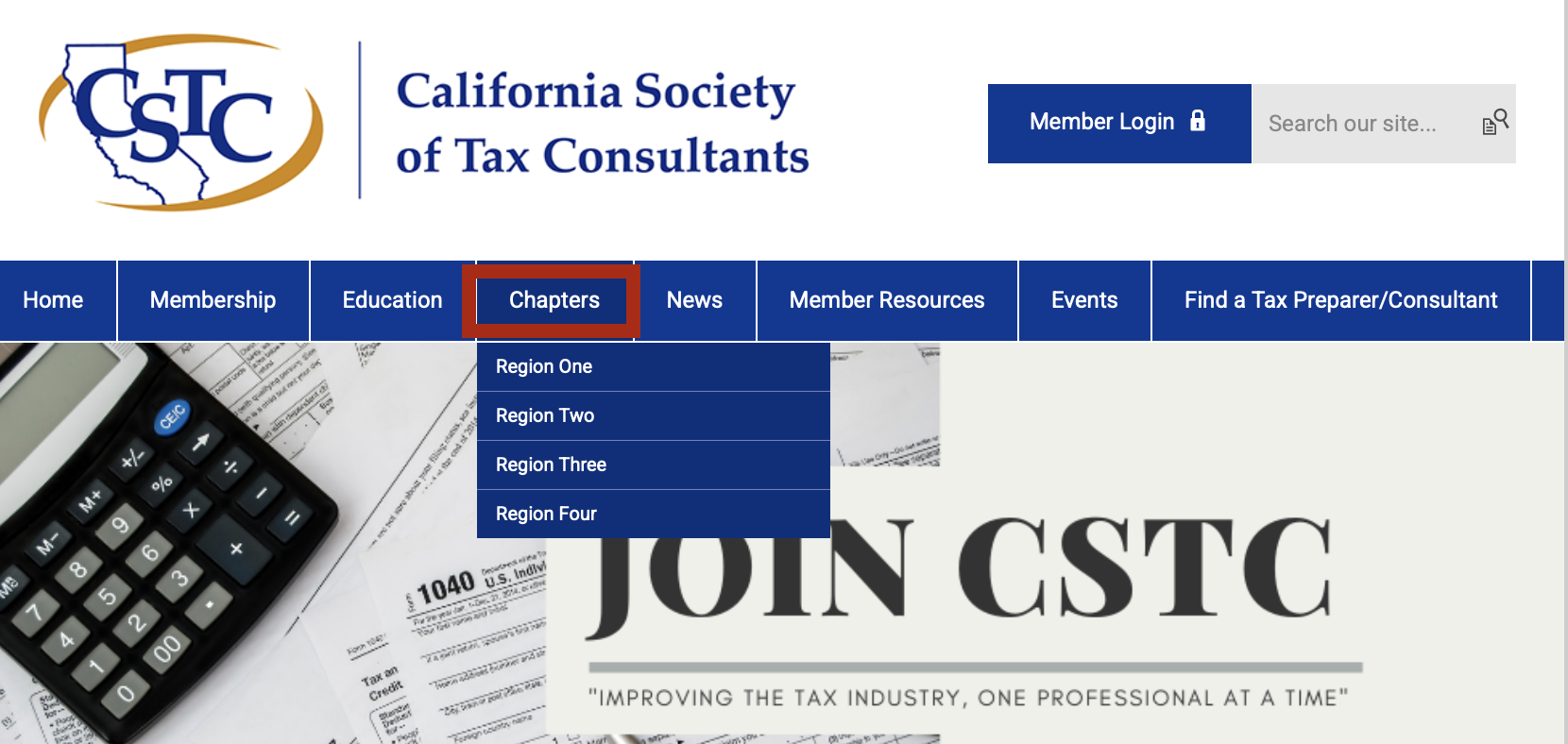

REPORTING IN-PERSON CONTINUING EDUCATIONThose attending an in-person event will receive a printed certificate of completion onsite. The continuing education will be reported within ten business days. When you receive your Certificate of Completion, please note that some sections will already be filled in (such as the date, course title, and CTEC course number). You will need to fill in your own information I ATTENDED A MEETING, BUT THE EDUCATION HAS NOT BEEN REPORTED TO MY CTEC/ IRS PROFILEIf you attended an event and the continuing education hours have not been reported to your IRS or CTEC account, please contact Kyra Browder at [email protected]. Be sure to include your license numbers and the title of the missing course so that your hours can be accurately reported. HOW DO I LOG IN TO MY MEMBER PROFILE?Member login can be found at the top right corner of every CSTC webpage, or you can click here HOW DO I RESET MY PASSWORD?Click here to reset your password HOW DO I RESET MY USERNAME?Click here to reset your username WHERE CAN I FIND INFORMATION ABOUT CSTC CHAPTERS?CSTC has 15 Chapters Statewide, making it easy to find education and networking opportunities in your area. Please click the chapters tab located on the blue bar across the top of the website, or click here to learn more. If you are not located near any of our chapters, we also have a member-at-large option.

WHERE DO I FIND EVENT INFORMATION FOR THE DIFFERENT CHAPTERS?Chapters list their information on their specific chapter webpage. You can view each chapter's webpage by hovering over the chapters tab located on the blue bar across the top of the website. Each chapter is grouped by region. Please see below for the four different regions and the chapter affiliates. I AM A MEMBER OF ONE CHAPTER BUT WANT TO ATTEND ANOTHER CHAPTER'S EVENT. IS THAT POSSIBLE?Absolutely! All members are assigned to a home chapter, giving them access to local chapter leaders and a supportive community. However, as a CSTC member, you are welcome to attend educational events hosted by any chapter throughout the state — and you’ll always receive the member pricing for those events. WHAT IS CSTC?The California Society of Tax Consultants, born in Southern California's "Inland Empire" in 1966, has approximately 900 members in 15 local chapters in California. CSTC's emphasis on high-quality tax education and its atmosphere of friendly sharing make it an ideal choice for tax professionals. WHO JOINS CSTC?Anyone who does tax work - tax preparers, bookkeepers, accountants, EAs, CPAs – part-timers, full-timers, beginners, and veterans. CSTC welcomes anyone who meets local requirements to prepare tax returns. CSTC also has a student membership for individuals enrolled in a tax or accounting class/program but not actively engaged in the profession of tax preparation or accounting WHY JOIN CSTC?Joining CSTC means becoming part of a respected community of tax professionals committed to advancing their expertise, networking with peers, and upholding high standards of practice. With CSTC you gain access to high-quality continuing education programs covering a broad range of tax topics—approved for CTEC, EA, and CPA credit, as well as a monthly meeting schedule through one of our 15 chapters statewide. Membership also brings networking opportunities and peer support in areas such as tax research, practice management, and interaction with the IRS, FTB, and EDD. Best of all, members enjoy discounted event rates and the professional credibility that comes from belonging to an organization with a strong code of ethics and a history dating back to 1966. Click here for a full list of membership benefits. HOW DO I JOIN CSTC?To learn more about joining CSTC and the different membership levels, click here. HOW DO I RENEW MY MEMBERSHIP?To renew your CSTC membership, please click here. HOW CAN ONE BECOME A TAX PREPARER IN CALIFORNIA?To learn more about becoming an Enrolled Agent (EA), click here. California law requires anyone who prepares (or assists with) tax returns for a fee, and is not an attorney, certified public accountant (CPA) or enrolled agent (EA), to register as a tax preparer with CTEC. |

.

.