|

CSTC's 2025 SUMMER TAX SYMPOSIUM

June 8 - 11, 2025

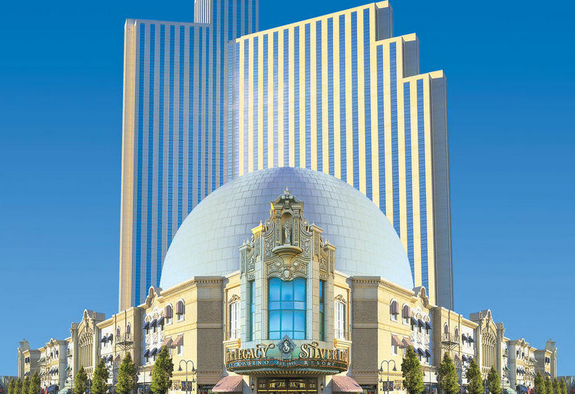

Silver Legacy Resort Casino

Reno, Nevada

The California Society of Tax Consultants, Inc. (CSTC) has been a nonprofit organization dedicated to supporting tax professionals across California since 1966 (formerly known as ISTC). CSTC is committed to providing high-quality education and exclusive member benefits. Whether you're a bookkeeper, accountant, CRTP, Enrolled Agent, or CPA, CSTC has something valuable to offer.

Our programs cover a wide range of tax topics, all approved for CTEC, EA, and CPA credit. Did you know you can earn all your CTEC credits for the year at the Symposium? That’s right—federal, update, ethics, and California hours, all in one event!

And guess what? The popular Lunch and Learn sessions are back! Your registration includes both breakfast and lunch each day of the event.

With an outstanding lineup of speakers and topics, there’s something for everyone, whether you’re a beginner or a seasoned tax preparer.

We can’t wait to see you in Reno! The CSTC Summer Tax Symposium is an event you won’t want to miss!

Quick Links

INTERESTED IN BECOMING A SPONSOR OR EXHIBITOR?

CSTC offers a variety of sponsorship, exhibition, and advertising opportunities tailored to help your company or firm gain prominent visibility, showcase new products and services, and significantly increase exposure. Whether you're showcasing something new or looking to reach a wider audience, our team will customize a sponsorship package to meet your unique marketing needs.

CSTC MEMBER MEMORIAL SCHOLARSHIP

CLICK HERE TO LEARN MORE!

OVERVIEW

The CSTC Symposium Memorial Scholarship offers financial support to cover the registration fee for CSTC members attending the 2025 Summer Symposium. Created in memory of Eva Rosenberg and Nikki LeBrun, two impactful CSTC leaders, the scholarship allows CSTC Chapters and individuals to contribute funds in their honor to support fellow members.

Summer Symposium Schedule-at-a-Glance

| |

Sunday, June 8, 2025

|

| 3:00 PM to 5:00 PM |

Registration Open; Exhibitor Set-up |

| 5:00 PM to 6:00 PM |

Welcome Reception for First-Time Attendees |

| 6:00 PM to 7:00 PM |

Welcome Reception (light appetizers will be served)

This event is family-friendly.

(Included with full registration. Guest registration is $95)

|

| |

Monday, June 9, 2025

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote Session: IRS Hot Topics: What’s New, What’s Changing, and What to Watch

Speakers: Tom Gorczynski, EA, USTCP, Ryan Reichert, EA, CFP, Jane Ryder, EA, CPA, and Claudia Stanley, CPA, EA |

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: Breaking Down the Brokerage Statement

Speaker: Shannon Hall, EA

|

| |

Track Two: Countdown to 2026 - Advising Estate Planning Clients Today!

Speaker: Frank Acuña, Attorney at Law

|

| |

Track Three: Disaster Casualty Losses: Tax Implications

Speaker: Jane Ryder, EA, CPA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Mastering the Tax Research Process: Analyzing Tax Authority

Speaker: Tom Gorczynski, EA, USTCP

|

| |

Track Two: Intro to Representation

Speaker: Josh Youngblood, EA

|

| |

Track Three: IRS Criminal Investigations for Non-Attorney Practitioners

Speaker: LG Brooks, EA, CTRS

|

| 12:00 PM to 1:20 PM |

Lunch and Learn: Tired of Going It Alone? Join the Movement Changing Tax Practice for Good

Sponsored and presented by:

No CE Offered for this Course

|

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Mastering the Tax Research Process: Practical Applications

Speaker: Tom Gorczynski, EA, USTCP |

| |

Track Two: 1031 Exchanges

Speaker: Ryan Reichert, EA, CFP |

| |

Track Three: Improving Data Security through Strategic Client Communications

Speaker: Brad Messner, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Business Tax Update

Speaker: Ryan Reichert, EA, CFP |

| 5:00 PM to 6:30 PM |

Reception with Exhibitors |

| |

Tuesday, June 10, 2025

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote: 2025 California Tax Updates

Speaker: Victoria Ramirez, FTB

|

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: The Power of the Research & Development Credit: Case Studies

Speaker: Brad Messner, EA

|

| |

Track Two: Community Property Law

Speaker: LG Brooks, EA, CTRS

|

| |

Track Three: Reconciling Clean Vehicle Credits

Speaker: Josh Youngblood, EA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: The Gig Is Up: Handling Income in Unique Industries

Speaker: Brad Messner, EA and Matt Metras, EA

|

| |

Track Two: Hit a Home Run With Your California Tax Update

Speaker: Patty Barron, EA

|

| |

Track Three: Successful Audits for Individuals, Rentals & Business

Speaker: Jane Ryder, EA, CPA

|

| 12:00 PM to 1:20 PM |

2025 Annual Business Meeting and Awards Ceremony Luncheon

(Included with registration) |

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Tax Quest: The Ultimate Year-End Tax Planning Adventure

Speaker: David Hilliard, EA, NTPI Fellow

|

| |

Track Two: California Property Tax Update

Speaker: Frank Acuña, Attorney at Law

|

| |

Track Three: Intro to: FBAR, FATCA, and FinCEN

Speaker: Claudia Stanley, CPA, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Individual Tax Update

Speaker: Tom Gorczynski, EA, USTCP

|

| 6:00 PM to 7:00 PM |

Audit Lounge: AI After Dark

Sponsored by:

No CE Offered for this Course

|

| |

Wednesday, June 11, 2025

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 8:20 AM to 10:05 AM |

Breakfast Keynote Session: Tax Stuff You Thought You Knew

Speaker: Shannon Hall, EA and Ryan Reichert, EA, CFP

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Retirement Tax Playbook: Navigating Key Tax Changes and Opportunities

Speaker: David Hilliard, EA, NTPI Fellow

|

| |

Track Two: Digital Assets 101

Speaker: Matt Metras, EA |

| |

Track Three: Fundamentals of Business Tax Balance Sheets

Speaker: Jane Ryder, EA, CPA

|

| 12:00 PM to 1:20 PM |

Lunch and Learn: The One Big Beautiful Bill Act: What Tax Pros Need to Know Now

Sponsored and presented by:

No CE Offered for this Course

|

| 1:20 PM to 3:00 PM |

General Session

Stump the Tax Experts

Speaker: Speaker Panel |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: 10 Commandments for Your Practice: Ethics

Speaker: Claudia Stanley, CPA, EA

|

| 5:15 PM |

Grand Prize Drawing |

Registration Information and Fees

| Category |

Fee by February 28, 2025 |

Fee by April 30, 2025 |

Fee After April 30, 2025 |

| Members |

$699 |

$749 |

$799 |

| Staff of Members |

$724 |

$774 |

$824 |

| Non-Members |

$924 |

$974 |

$1,024 |

| Sunday Night Reception Guest Tickets (appetizers served) |

$95 |

$95 |

$95 |

Registration fees include: Educational sessions and materials, including a USB drive with electronic handouts, daily breakfasts, lunches, refreshment breaks, and a Sunday evening reception. Registrants will also receive the electronic handouts via email after the Symposium.

Optional Printed Handouts: $200 for a complete set of session handouts (covering all sessions, regardless of your selections). The materials will be in book format and provided at check-in.

The deadline to order printed handouts is May 30, 2025. See FAQ's for more details.

Cancellation Policy: Written/emailed requests for a registration fee refund will be accepted until May 9, 2025. A $200 administrative fee will be deducted from all refunds. No refund of any kind will be given if a written cancellation notice is received after May 9, 2025. There are no refunds for no-show registrants.

Hotel Information

Silver Legacy Resort and Casino

407 North Virginia Street

Reno, Nevada 89501

1-800-687-8733

http://www.silverlegacyreno.com/

Check-in time is 3:00 PM and check-out time is 12:00 PM.

$62 plus tax/fees and a resort fee of $25 per guestroom per night, single or double occupancy until block sells out Sunday through Wednesday night.

Any reservations made on nights outside Sunday through Wednesday are $139 plus tax and fees, with an additional $25 per night resort fee.

A daily resort fee of $25.00 per room, per night plus the current occupancy room tax will be charged in addition to the room rates set forth above. This fee includes:

• In-room Keurig® coffee maker with Starbucks® K-Cup® Pods

• Unlimited local and toll-free calls

• Refrigerator and in-room safe*

• Airport shuttle service and self-parking

• Access to the all-new Fitness Center inside The Spa at Silver Legacy

• Printing of boarding passes, notary services, and safety deposit box access.

Located in the heart of the Biggest Little City, Silver Legacy Resort Casino offers everything under one roof. This modern Reno hotel has restaurants, big-name entertainment and an action-packed casino. Silver Legacy also has gorgeous mountain views and is a quick drive from Lake Tahoe.

Session Descriptions

Breakfast Keynote: IRS Hot Topics: What’s New, What’s Changing, and What to Watch

Speakers: Tom Gorczynski, EA, USTCP, Ryan Reichert, EA, CFP, Jane Ryder, EA, CPA, and Claudia Stanley, CPA, EA

Session Description: Stay current with the latest developments affecting tax professionals and their clients in this dynamic panel discussion. From legislative updates and IRS operational shifts to enforcement trends, digital modernization, and preparer responsibilities, this session will cover the most talked-about issues in IRS practice today. Panelists will highlight emerging risks, new compliance priorities, and what tax professionals need to know to stay ahead in a rapidly evolving tax environment.

1 Federal Update hour

IRS: 18QC1-U-02139-25-I

CTEC: 1000-CE-05610

Knowledge Level: Update (Information on new tax laws)

Breaking Down the Brokerage Statement

Speaker: Shannon Hall, EA

Session Description: Are you baffled by brokerage statements? Do you find yourself 1099-Bewildered? Join us as we go beyond the dividends and interest to sort through the many pages of the consolidated brokerage statement and discover the information you need to properly report income items.

Learning Objectives:

#1: Review the basics of the brokerage statement including 1099-DIV, 1099-INT and stock transactions.

#2: Discuss less common items such as contracts and straddles, unique interest items, and miscellaneous items including fees and margin interest.

#3: Understand the reporting of sales of employee stock and where to locate the additional information needed for accurate tax reporting.

1 Federal Law hour

IRS #: 18QC1-T-02075-25-I

CTEC #: 1000-CE-5542

Knowledge Level: Basic (No prior knowledge expected)

Countdown to 2026 - Advising Estate Planning Clients Today!

Speaker: Frank Acuña, Attorney at Law

Session Description: Many of the provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) are temporary. The revised estate and gift tax limits will expire on December 31, 2025, reducing the exemption equivalent by approximately 50%. What are tax and financial planners to do? Focusing on case studies, this course will examine the most popular and effective estate tax planning tools which can be used for the rest of 2025, and beyond. This course is taught by a California State Bar Certified Specialist in Estate Planning, Probate and Trust Law who works daily with Enrolled Agents and clients to obtain optimum estate tax planning outcomes.

Learning Objectives:

#1: Understand the similarities and differences between the TCJA and the “permanent” estate and gift tax laws under the American Taxpayer Relief Act of 2013.

#2: Examine the permanent “portability” laws and their impact on gift and estate tax planning and whether credit shelter trusts should still be used.

#3: Using real-life case studies, discuss the current and continued viability of estate planning tools such as SLATs, ILITs, CRTs, CLTs, and LLCs.

1 Federal Law hour

IRS: 18QC1-T-02115-25-I

CTEC: 1000-CE-05583

Knowledge Level: Basic (No prior knowledge expected)

Disaster Casualty Losses: Tax Implications

Speaker: Jane Ryder, EA, CPA

Session Description: Several areas of the tax code are intended to offer relief for taxpayers affected by disaster events. Learn where to find up-to-date IRS guidance for areas affected by a disaster, determine which areas have been approved for tax postponements, how to easily contact the IRS Disaster Hotline, and how to determine state conformity with IRS relief. This course will review the available options for accessing retirement funds penalty-free with favorable repayment terms. We'll also cover valuable information related to tax issues for deductible disaster losses, taxability of insurance reimbursements and other funds received related to the disaster, including basis calculations for property and involuntary conversions of destroyed property. Affected tax practitioners can also provide relief to clients who may not be in the disaster area.

Learning Objectives:

#1: Learn how to find and stay up-to-date on IRS guidance and state conformity for disaster relief for taxpayers.

#2: Determine the tax impact of insurance reimbursements and other funds received related to the disaster.

#3: Accurately calculate casualty losses, property basis, and other issues such as involuntary conversions.

1 Federal Law hour

IRS #: 18QC1-T-02086-25-I

CTEC #: 1000-CE-5552

Knowledge Level: Basic (No prior knowledge expected)

Mastering the Tax Research Process: Analyzing Tax Authority

Speaker: Tom Gorczynski, EA, USTCP

Session Description: This is part one of a two-class sequence in tax research. After discussing the legal and ethical reasons why tax research is an essential skill, we will delve into the actual tax authorities and how to read them. We will also discuss the usefulness of non-authoritative sources. The standards used in tax research, such as reasonable basis and substantial authority, will also be reviewed and why they matter in the tax research process.

Learning Objectives:

#1: List the various tax authorities that can be used to take tax positions.

#2: Compare and contrast reasonable basis from substantial authority.

#3: Understand how non-authoritative sources can be used in the tax research process.

2 Federal Law hours

IRS #: 18QC1-T-02070-25-I

CTEC #: 1000-CE-5536

Knowledge level: Basic (No prior knowledge expected)

Intro to Representation

Speaker: Josh Youngblood, EA

Session Description: This beginner course is designed for tax professionals who want to get started with IRS representation. Learn the basics of Forms 8821 and 2848, when to use each form, and best practices for representing clients. You will gain the confidence to represent your clients through case studies and practical examples.

Learning Objectives:

#1: Learn how to get started representing clients before the IRS

#2: Understand the differences between Forms 8821 and 2848 and know when to use each form

#3: Understand the various types of transcripts available from the IRSDevelop best practices for resolving client cases through real-life case studies and practical strategies

2 Federal Law hours

IRS #: 18QC1-T-02091-25-I

CTEC #: 1000-CE-5557

Knowledge level: Basic (No prior knowledge expected)

IRS Criminal Investigations for Non-Attorney Practitioners

Speaker: LG Brooks, EA, CTRS

Session Description: Tax representatives may be engaged to provide taxpayers and clients with professional, accurate, and legal tax advice concerning various tax matters. However, a “thin gray line” may exist between advising taxpayers pertaining to a civil tax matter and when or if the matter develops into a potential criminal matter. Non-attorney tax practitioners and representatives may be required to decide between an aggressive civil tax approach versus a non-aggressive (but firm) potentially criminal tax perspective and knowing when & how to extract themselves from an IRS criminal investigation matter. The tax practitioner should be careful to maintain ethical and professional standards to avoid becoming a “target” or a “subject” of the criminal investigation as well.

Learning Objectives:

#1: Understanding how to properly interact with IRS-CI upon initial contact, Understanding how “privilege” works with respect to a criminal investigation

#2: Determining how to control initial interaction between the taxpayer & IRS-CI personnel, Discussing, determining & understanding the taxpayer’s rights during a criminal investigation

#3: Understanding how & when the client should invoke their 5th Amendment Privilege. We will also discuss IRS Summons, Search Warrant Procedures & many other CI related issues

2 Federal Law hours

IRS #: 18QC1-T-02073-25-I

CTEC #: 1000-CE-5540

Knowledge Level: Intermediate (Basic knowledge helpful)

Lunch and Learn: Tired of Going It Alone? Join the Movement Changing Tax Practice for Good

Session Description: If you’ve ever felt like you’re on an island during tax season, you’re not alone — and it doesn’t have to be that way. Join us for a powerful Lunch & Learn at the CSTC Summer Symposium, featuring a special presentation from InCite, a collaborative tax community built by and for professionals like you.

Learn how real-time support, shared tools, and meaningful connection can reshape how you work and how you feel about your business. Discover how to plug into a community that supports you year-round with relevant, accurate information — no competition, just connection.

Sponsored and presented by:

No CE offered for this course

Mastering the Tax Research Process: Practical Applications

Speaker: Tom Gorczynski, EA, USTCP

Session Description: This is part two of a two-class sequence in tax research. The focus of this class is using a standardized tax research process to locate tax authority, apply it to a set of facts, and decide regarding a tax return position. We will review the use of free and paid research tools, including artificial intelligence (AI), to find and analyze tax authority.

Learning Objectives:

#1: Compare and contrast free research sources and paid research sources

#2: Describe the essential elements of a tax research process

#3: Apply a tax research process to scenarios from tax practice

2 Federal Law hours

IRS #: 18QC1-T-02071-25-I

CTEC #: 1000-CE-5538

Knowledge Level: Basic (No prior knowledge expected)

1031 Exchanges

Speaker: Ryan Reichert, EA, CFP

Session Description: Is this you? You’ve taken classes about like-kind exchanges and think you know the concepts, but when it comes time to actually enter the transaction into your software, you suddenly feel lost. It’s not your fault! To complete like-kind exchange calculations, you really only need 6 numbers:-FMV of the old and replacement properties-Basis of the old property-Loan amounts on the old and replacement properties-Total expenses from the settlement statements.You know where to get all those numbers, right? So why does your software make it so hard?!? And when a client asks about the tax ramifications of doing a like-kind exchange, does it take you hours to run all the possible scenarios? In this class, a simple worksheet and a checklist will solve both of these problems for you, giving you a new understanding of the basic concepts and allowing you to quickly provide your clients with accurate advice about the outcome of their planned exchanges.

Learning Objectives:

#1: Identify what types of property are eligible for 1031 exchange treatment.

#2: Analyze settlement statements to determine items that impact the tax consequences of the exchange.

#3: Learn and understand advanced tax strategies related to 1031 exchanges.

2 Federal Law hours

IRS #: 18QC1-T-02082-25-I

CTEC #: 1000-CE-5549

Knowledge Level: Intermediate (Basic knowledge helpful)

Improving Data Security through Strategic Client Communications

Speaker: Brad Messner, EA

Session Description: Data security is a topic we tend to avoid when working with our clients, as it creates anxiety and incites fear. Through the use of strategic conversations and powerful, direct communications, we have the opportunity to increase our clients' understanding of security and embrace our operational and legal requirements.

Learning Objectives:

#1: With the increase in data security-related risks and compliance, tax professionals are under more strain to comply with ever-changing demands. Attendees will better understand the regulatory requirements they must comply with in 2025.

#2: Added security requirements place additional stress on the relationship between tax professionals and clients; we will focus on how to improve the communication, education, and training process, encouraging clients to improve their data strategies.

#3: Attendees will leave with a solid understanding how of how to meld client communication with improved security, ensuring that safeguard requirements are followed and also that clients appreciate the added effort their tax professional takes to secure their personal information.

2 Federal Law hours

IRS #: 18QC1-T-02078-25-I

CTEC #: 1000-CE-5545

Knowledge Level: Basic (No prior knowledge expected)

General Session - Business Tax Update

Speaker: Ryan Reichert, EA, CFP

Session Description: This session will be dedicated to tax changes related to business taxation that will apply for the 2025 tax year. We will also discuss expiring tax provisions impacting small/medium-sized businesses and proper planning for such provisions.

Learning Objectives:

#1: Identify potentially expiring TCJA provisions and tax planning strategies to consider in light of those changes.

#2: Analyze and review the rules for business sales.

#3: Understand new tax strategies applicable for the 2025 taxable year.

2 Federal Update hours

IRS #: 18QC1-U-02084-25-I

CTEC #: 1000-CE-5550

Knowledge level: Intermediate (Basic knowledge helpful)

Breakfast Keynote: 2025 California Tax Updates

Speaker: Victoria Ramirez, FTB

Session Description: This course will discuss the role of the Franchise Tax Board’s Taxpayers’ Rights Advocate’s Office and will provide updates on legislative matters and other current state tax topics

1 California hour

IRS: N/A

CTEC: 1000-CE-05609

Knowledge Level: Update (Information on new tax laws)

The Power of the Research & Development Credit: Case Studies

Speaker: Brad Messner, EA

Session Description: The research and development (R&D) tax credits are some of the most powerful yet underutilized tax creditswe can apply for our clients today. It's more than just lab coats and chemical formulas; the R&D credits reachso much further than what many realize. In this session, we will explore the R&D credits and what researchactivities and expenses qualify. Particular focus will be on applying for the credit in areas many preparerstypically miss or under-apply, leaving thousands of dollars on the table.

Learning Objectives:

#1: Attendees will learn how to apply the R&D Credit to a wide variety of industries, not just those that people typically believe apply. Case studies will be used to provide talking points for clients.

#2: Attendees will learn what records and document management is required, especially in cases where clients were not aware that they could have qualified.

#3: Using case studies and AI, Attendees will be able to draft easy to explain and distribute communications to assist their clients in determining if the R&D Credit could apply to them.

1 Federal Law hour

IRS #: 18QC1-T-02079-25-I

CTEC #: 1000-CE-5546

Knowledge level: Intermediate (Basic knowledge helpful)

Community Property Law

Speaker: LG Brooks, EA, CTRS

Session Description: The application of existing “Community Property” law with respect to the resolution of a federal tax matter can be confusing, ambiguous and somewhat vague at times. This situation usually develops during the representation of a taxpayer concerning a collection or audit tax matter. Typically, recognition and implication of the “State Community Property” laws (which vary from state-to-state) has a profound effect upon the presentation of a tax matter before the Internal Revenue Service (IRS). This presentation is designed to discuss explore and explain the current applicable legal guidelines & appropriate administrative procedures (both State & Federal) pertaining to community property issues.

Learning Objectives:

#1: How to properly prepare an Installment Agreement concerning a liable or non-liable spouse. How to properly prepare an Offer-in-Compromise concerning a liable or non-liable spouse. How the IRS requires the invocation of State Community Laws with respect to a federal

#2: How to define community income & community expenses. How to calculate community income & allowable community expenses. How to determine when a married individual is not subject to Community Property Law

#3: The effect of a Pre-Nuptial or Post Nuptial Agreement in each Community Property State. How to recognize & define separate assets for Community Property purposes. How to implement the “Abandoned Spouse” rule in a Community Property tax situation. How Community Property Law applies to “Register Domestic Partners”, and other matters

1 Federal Law hour

IRS #: 18QC1-T-02074-25-I

CTEC #: 1000-CE-5541

Knowledge level: Intermediate (Basic knowledge helpful)

Reconciling Clean Vehicle Credits

Speaker: Josh Youngblood, EA

Session Description: The Inflation Reduction Act (IRA) of 2022 introduced new incentives and broadened existing tax credits for clean energy vehicle purchases. As of 2024, eligible buyers can now transfer these credits directly to the dealership at the point of sale. However the credit must be reconciled when filing their tax return. We will go through the reconciliation process and review the key eligibility criteria for both the clean vehicle and previously owned clean vehicle credits.

Learning Objectives:

#1: Identify the eligibility criteria for claiming both the clean vehicle credit and the previously owned clean vehicle credit

#2: Demonstrate how to properly complete Form 8936 and Schedule A to reconcile the clean vehicle credit on a tax return

#3: Discuss timing issues when claiming clean vehicle credits alongside residential energy credits in the same year and tax planning opportunities

1 Federal Law hour

IRS #: 18QC1-T-02113-25-I

CTEC #: 1000-CE-5581

Knowledge level: Basic (No prior knowledge expected)

The Gig Is Up: Handling Income in Unique Industries

Speakers: Brad Messner, EA and Matt Metras, EA

Session Description: Taxpayers are finding unique means to earn income, and many questions have come up about what income needs to be claimed on an annual return and what are permissible deductions for business purposes. Some of the taxpayers most commonly impacted include social media influencers or brand ambassadors, OnlyFans content contributors, cryptocurrency purchasers, online gamblers, and more.

Learning Objectives:

#1: Understand and speak to the complexities of unique income sources, including gauging the legality of each activityDiscern what deductions are permitted for unique industries and how to include these deductions on individual and entity tax returnsIdentify unique deductions to propose to clients that are not typical outside of unique industriesGain a core understanding of these industries and how to best serve clients who work in them

2 Federal Law hours

IRS #: 18QC1-T-02081-25-I

CTEC #: 1000-CE-5548

Knowledge Level: Basic (No prior knowledge expected)

Hit a Home Run With Your California Tax Update

Speaker: Patty Barron, EA

Session Description: California has the most MLB teams in the nation! And it seems like California also has the most tax laws, as well. Regardless of which team holds your baseball heart - or even if your heart holds a different sport - it's important to stay up on the latest "game rule" changes. Prepare to take the field and Hit a Home Run with this California Tax Law Update. We will cover the newest updates to the CA tax codes, review credits, dependency issues, income and income sourcing (why are so many athletes CA non-residents?) And review some of those oft- missed CA deductions.

Learning Objectives:

#1: How to properly allocate income to California in today's unique world of multi-state workers.

#2: Identify new legislation and CA tax reporting requirements.

#3: Properly report income and deductions on the CA return.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-5539

Knowledge Level: Basic (No prior knowledge expected)

Successful Audits for Individuals, Rentals & Business

Speaker: Jane Ryder, EA, CPA

Session Description: Best practices for audits of individuals' Schedule A, Schedule C, and Schedule E plus S corps, C corps, partnerships & LLCs. Schedule A issues to consider. For rentals and business analyzing taxpayer records to support gross proceeds reported and substantiate business expenses. Review issues with different expenses, including home office and auto expenses. Learn to establish rapport with an auditor, advocate for your client, and negotiate reduced audit scope. Plus, audits gone wrong; audit reconsideration, audit appeals, etc. Real-life examples with great outcomes. Review tax situations that may create a greater risk of audit and areas of interest for IRS audits.

Learning Objectives:

#1: Review audit exposure issues related to Form 1040, Schedule A.

#2: Learn processes to analyze and summarize rental and business income and expenses for audit.

#3: Consider best practices for working with auditors for best outcomes for your clients.

2 Federal Law hours

IRS #: 18QC1-T-02087-25-I

CTEC #: 1000-CE-5553

Knowledge level: Basic (No prior knowledge expected)

Tax Quest: The Ultimate Year-End Tax Planning Adventure

Speaker: David Hilliard, EA, NTPI Fellow

Session Description: Embark on the "Tax Quest," an epic adventure designed to equip tax professionals with the ultimate year-end planning and reduction strategies. In this quest, participants will journey through different "lands," each representing a critical area of tax planning. Along the way, you will face challenges, solve puzzles, and gather valuable "treasures" (tax strategies) to help your clients minimize their tax liabilities through actual Tax Projection Scenarios. This immersive experience will transform you into a master adventurer in the realm of tax planning, ensuring your clients reach their financial goals with ease.

Learning Objectives:

#1: Master Key Year-End Tax Strategies: Equip participants with advanced techniques to maximize tax savings for clients through effective year-end planning.

#2: Enhance Client Advisory Skills: Improve participants' ability to advise clients on tax reduction opportunities, ensuring compliance while optimizing financial outcomes.

#3: Develop Strategic Thinking for Tax Planning: Foster participants' ability to think strategically and solve complex tax scenarios, preparing them for any challenges they may face.

2 Federal Law hours

IRS #: 18QC1-T-02076-25-I

CTEC #: 1000-CE-5543

Knowledge level: Intermediate (Basic knowledge helpful)

California Property Tax Update

Speaker: Frank Acuña, Attorney at Law

Session Description: You saw the commercials. Proposition 19 was to be the salvation of senior citizens and natural disaster victims.But nobody was talking about the effect it would have on our children.This course overviews California’s property tax system and how property tax exclusions historically have worked. Then, we will take a deep dive on Prop. 19, and how the game has changed for seniors, natural disaster victims, and the Parent-to-Child Exclusion. Finally, we examine current, cutting edge strategies for reinstating property tax strategies for multiple-generation family wealth.

Learning Objectives:

#1: Review and understand California’s property tax system

#2: Understand the historic application of Prop.13 and Prop. 58, and the changes caused by Prop 19.

#3: Examine the hidden pitfalls of transferring a family residence to children, and the way to avoid them and a cutting-edge strategy using Limited Liability Companies for investment real estate.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-05584

Knowledge level: Basic (No prior knowledge expected)

Intro to: FBAR, FATCA, and FinCEN

Speaker: Claudia Stanley, CPA, EA

Session Description: This course gives a brief overview of foreign filing requirements and compliance for U.S. taxpayer with F-Bar, FATCA, and FinCEN. This is an introduction to preparing the forms related to these requirements. This is an introductory course, meant to address the most common scenarios. Attendees will learn the filing deadlines and various thresholds. We will look at filling out FinCEN 114 (F-Bar), Form 8938, Form 3520, a brief update on Beneficial Ownership Information reporting.

Learning Objectives:

#1: When is filing an FinCEN 114 (F-BAR) necessary and what are the basics of completing the form.

#2: When is filing Form 8938, Statement of Foreign Financial Assets necessary and what are the basics of completing the form.

#3: When is filing Form 3520, Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts necessary and what are the basics of completing the form.

2 Federal Law hours

IRS #: 18QC1-T-02089-25-I

CTEC #: 1000-CE-5555

Knowledge level: Basic (No prior knowledge expected)

General Session - Individual Tax Update

Speaker: Tom Gorczynski, EA, USTCP

Session Description: This course reviews key tax law changes and trends that impact the taxation of individuals in the past year. Emphasis will be given on changes in 2025 and forward with respect to the expiration of the Tax Cuts and Jobs Act (TCJA) and possible legislation in 2025 to continue and modify TCJA.

Learning Objectives:

#1: Describe how new tax legislation enacted by Congress impacts individual taxation.

#2: Explain how new IRS guidance and court cases impact individual taxation.

#3: Describe how existing tax law principles apply to new trends applicable to individuals.

2 Federal Update hours

IRS #: 18QC1-U-02072-25-I

CTEC #: 1000-CE-5537

Knowledge Level: Update (Information on new tax laws)

Audit Lounge: AI After Dark

More information coming soon!

Sponsored by:

No CE offered for this course.

Breakfast Keynote Session - Tax Stuff You Thought You Knew

Speaker: Shannon Hall, EA and Ryan Reichert, EA, CFP

Session Description: We’ve all had those “light bulb” moments when we realize that we’ve been missing out on a great tax deduction for a client or have overlooked a perfect tax planning opportunity. These revelations come from many sources: sometimes, it’s the one really useful piece of information we learn at a seminar, or a colleague mentions something at lunch that gets us thinking, or we are researching another tax topic and come across something totally unexpected.You are in “Jeopardy” of having fun while you learn in this fast-paced seminar. All NEW topics for 2025!You’ll have at least one “AH HAH!” moment, guaranteed!

Learning Objectives:

#1: Reconsider and clarify rules for long-standing tax rules and principles.

#2: Identify key misunderstandings of tax rules and regulations to find additional tax savings opportunities and traps that your clients should avoid.

#3: Learn how to add value and bill accordingly for the tax strategies presented in this session.

2 Federal Law hours

IRS #: 18QC1-T-02085-25-I

CTEC #: 1000-CE-5551

Knowledge level: Intermediate (Basic knowledge helpful)

Retirement Tax Playbook: Navigating Key Tax Changes and Opportunities

Speaker: David Hilliard, EA, NTPI Fellow

Session Description: This course is tailored for tax professionals who want to excel in retirement tax planning. With a focus on the Tax Cuts and Jobs Act (TCJA), SECURE Act, SECURE Act 2.0, and the Inflation Reduction Act (IRA), participants will learn to navigate key legislative changes and develop strategies to optimize retirement outcomes for their clients. The course delves into Roth conversions, inherited IRA strategies, and managing taxable investment accounts, equipping professionals with actionable insights to enhance their advisory services and client relationships.

Learning Objectives:

#1: Analyze the tax implications of the SECURE Act and SECURE Act 2.0 to guide clients in adjusting retirement and legacy strategies.

#2: Design and implement tax-efficient plans for Roth conversions, inherited IRAs, and taxable investment accounts to optimize client outcomes.

#3: Integrate legislative changes and advanced planning strategies into a comprehensive retirement tax plan tailored to client-specific needs.

2 Federal Law hours

IRS #: 18QC1-T-02077-25-I

CTEC #: 1000-CE-5544

Knowledge level: Intermediate (Basic knowledge helpful)

Digital Assets 101

Speaker: Matt Metras, EA

Session Description: An introduction to digital asset taxation, covering the basics of blockchain and cryptocurrency and how to report common crypto situations. We will cover IRS guidance to date and discuss options on how to treat situations not covered by guidance. This class will help you guide the average taxpayer through the most frequent tax situations. We will also discuss tools that can be used to help simplify the process.

Learning Objectives:

#1: Identify what cryptocurrency and digital assets are and how they function

#2: Review current IRS guidance and substantial authority

#3: Identify transactions most likely to be encountered by the taxpayerInterpret your specific client situations and apply IRS guidance accordingly

2 Federal Law hours

IRS #: 18QC1-T-02080-25-I

CTEC #: 1000-CE-5547

Knowledge level:

Fundamentals of Business Tax Balance Sheets

Speaker: Jane Ryder, EA, CPA

Session Description: Develop best practices for preparing and reporting business tax return balance sheets. Determine the appropriate way to work with each entity's available accounting reports, from simple P and Ls which require you to develop and maintain the balance sheet yourself, to a complete and accurate set of financial statements prepared by the client, and everything in between! We'll discuss balance sheet items affecting basis such as retained earnings, shareholder or partner loans, and non-deductible expenses reported on Schedule M1, decisions regarding classifying transactions based on basis considerations, educating the client on balance sheet issues, and more.

Learning Objectives:

#1: Understand basic balance sheet fundamentals for a complete & accurate tax return.

#2: Develop best practices for supporting tax balance sheets with available client reports.

#3: Identfy how Schedule L, Schedule M-1, and Schedule M-2 interact on a tax return.

2 Federal Law hours

IRS #: 18QC1-T-02088-25-I

CTEC #: 1000-CE-5554

Knowledge Level: Basic (No prior knowledge expected)

Lunch and Learn: The One Big Beautiful Bill Act: What Tax Pros Need to Know Now

Session Description: Congress is poised to pass major tax legislation—dubbed the One Big Beautiful Bill Act—with sweeping implications for individual and business taxation. While the legislative process is still underway, this session will provide a broad, high-level overview of the bill’s key provisions as currently proposed, including changes to income tax rates, business deductions, credits, and more. Attendees will walk away with a clear understanding of what’s likely coming, what’s still in flux, and how to prepare clients for the year ahead. This is your first look at the tax world’s next big shift—don’t miss it.

Sponsored and presented by:

No CE offered for this course

General Session - Stump the Tax Experts

Speaker: Speaker Panel

Session Description: This is a special question-and-answer session with our unique panel of Tax Experts that includes many of our terrific speakers who have agreed to let us test their tax knowledge! Do you have a burning question that is driving you crazy because you cannot find the answer on your own? Did you learn something in one of your classes that needs further explanation for you to understand the tax concept? Questions will be collected during the Symposium.

2 Federal Law hours

IRS #: 18QC1-T-02088-25-I

CTEC #: 1000-CE-5554

Knowledge level: Basic (No prior knowledge expected)

General Session - 10 Commandments for Your Practice: Ethics

Speaker: Claudia Stanley, CPA, EA

Session Description: The new normal seems to be a state of constant chaos and uncertainty. When the pressure is on ethical procedures are more important and easier to overlook. Conducting business in a virtual environment brings a whole new set of challenges to our firms. The course will not only visit the standards for practitioners but also look at various situations drawn from real life. Thinking through a course of action before coming under fire will protect you and your clients. The course will breakdown 10 basic areas of Circular 230 impacting the everyday practice of tax professionals. We'll look at various examples of those who broke the commandments and their consequences.

Learning Objectives:

#1: Recognize when an ethical situation or conflict arises.

#2: Learn how Circular 230 applies to each situation.

#3: Thinking beyond Circular 230, how will you react to client when under stress.

2 Ethics hours

IRS #: 18QC1-E-02090-25-I

CTEC #: 1000-CE-5556

Knowledge level: Basic (No prior knowledge expected)

About the Presenters

Frank Acuña, Attorney at Law Frank Acuña, Attorney at Law

Frank R. Acuña is a founding partner of ACUÑA ❖ REGLI. He is a California State Bar-certified estate planning, trust, and probate law specialist. His practice includes estate planning; inheritance litigation; business succession planning; special needs trusts; and farm, ranch, and vineyard succession planning. Mr. Acuña has taught tax seminars for the National Tax Practice Institute, the California Society of Enrolled Agents, the California Society of Tax Consultants, a number of state and local chapters of the National Association of Enrolled Agents, and the American Institute of Certified Public Accounts. Mr. Acuña also is a featured speaker for the Professional Fiduciary Association of California, the National Guardianship Association, and the California Public Administrators, Public Conservators, and Public Guardians. He advises tax, fiduciary, and real estate professionals throughout the State of California.

Patty Barron, EA Patty Barron, EA

A member of the Orange County CSTC Chapter, Patty currently serves as 1st Vice President/Education Chair. A believer in lifelong learning, she enjoys sharing knowledge and experience with fellow tax professionals. Patty has been preparing taxes since 1992 and has a practice in Fullerton, CA focusing on Individuals and Small Business taxes.

Patty is also a retired 9-1-1 Dispatcher and originally moonlighted as a tax preparer. Believe it or not, the two careers have a lot in common! Her favorite saying is “taxes are about the people, not the math.”

Patty has been a public speaker and presenter in both her career fields. She is a regular presenter at the Orange County Chapter including their annual Tax Update Forum, Tax Preparer Security and California topics. As a 9-1-1 Dispatcher she was a lead trainer for new dispatchers, instructed and certified groups in state computer systems access and did public presentations to Neighborhood Watch events.

LG Brooks, EA, CTRS LG Brooks, EA, CTRS

LG Brooks is an Enrolled Agent and is the former Senior Consultant of The Tax Practice, Inc., located in Dallas Texas. However, LG is now the Senior Tax Resolution Consultant with Lawler & Witkowski, CPAs and EAs which is headquartered in Buffalo, NY. LG has been in the field of taxation for more than 25 years and has been in practice full time since 1990. LG’s areas of practice include Tax Representation and Pre-Tax-Court Litigation Support Services. LG continues to provide tax presentations for numerous tax and accounting societies and has made presentations at several Internal Revenue Service (IRS) Annual Tax Forums. LG received a Bachelor of Arts degree from Bishop College at Dallas, Texas in 1977 and is a Fellow of the National Tax Practice Institute (NTPI). He is currently a faculty member of the National Tax Practice Institute (NTPI) and he is extremely proud and honored to be an Enrolled Agent.

Tom Gorczynski, EA, USTCP Tom Gorczynski, EA, USTCP

Thomas A. Gorczynski, EA, USTCP is a nationally recognized speaker and educator on federal tax law matters. He is the author of the Tom Talks Taxes newsletter, the co-author of the PassKey Learning Systems EA Review Series, and co-owner of Compass Tax Educators. He is an Enrolled Agent, a Certified Tax Planner, a National Tax Practice Institute Fellow, and admitted to the bar of the United States Tax Court as a non-attorney.

Shannon Hall, EA Shannon Hall, EA

Shannon Hall, EA, is a tax professional based in Long Beach, CA. Her diverse client base keeps her on the cutting edge of new tax developments. Shannon is a featured speaker for tax societies nationwide and a writer and presenter for Brass Tax Presentations. She holds degrees in both Accounting and Theatre Arts, which aids her in creating captivating and informative tax presentations.

She has served as the First Vice President of CSTC in charge of education for three years, as well as participating on the board of her local chapter in Orange County. Shannon was named CSTC Member of the Year for 2023.

David Hilliard, EA, NTPI Fellow David Hilliard, EA, NTPI Fellow

David graduated from Cal Poly Pomona in 2001 with a degree in Animal Health Science. After 20 years as a knight at Medieval Times, he traded his sword for a calculator and entered the tax industry in 2009. Now, instead of defending castles, David defends taxpayer rights with over 25 years of management and customer service experience, representing clients before the IRS and other government agencies.

In addition to his client work, David enjoys helping his fellow tax professionals through teaching continuing education and sharing strategies to improve their practices. He is passionate about mentoring and supporting others in the industry to achieve their best.

Despite his best efforts to stay out of the spotlight, David's passion for service has led him to volunteer for just about every leadership role possible within the California Society of Enrolled Agents, both at the state and local levels. Currently, he finds himself as the Immediate Past President of CSEA, proving that once you're in, you're never really out. At Chatterton and Associates. Inc., David channels this same enthusiasm into organizing and mentoring a team of Enrolled Agents (EAs), Certified Public Accountants (CPAs), and California Tax Education Council (CTEC) registered tax preparers.

Outside of work, David enjoys time with his wife Patricia, their three children, Ella, Melody, and Wyatt, and their golden retriever, Montana—when he’s not busy riding to the rescue of clients in distress.

Brad Messner, EA Brad Messner, EA

Brad Messner is a third-generation owner of Messner & Fox, LLC located just outside of Pittsburgh, PA. He is the firm’s first Enrolled Agent and has 25 years of experience specializing in research credits, farming, commercial beverage (wineries, distilleries, and breweries), tech/startups, and corporate tax preparation as well as an in-depth understanding of data security, due diligence, and entity selection. Obtaining complimentary bachelor’s degrees in information systems and business management with a concentration in accounting from the University of Pittsburgh coupled with an MBA with a focus in information systems from the Indiana University of Pennsylvania, Brad has a robust background in accounting, financial systems, and information systems.

Upon the passing of his father in 2009, Brad stepped up to the role of Vice President at Messner & Fox, LLC where he works diligently with their staff providing tax preparation, tax planning, bookkeeping, and payroll services to a client base of several thousand clients across 30+ states and over 8 countries. Bringing

representation services into the firm shortly afterer becoming an Enrolled Agent, Messner & Fox, LLC has assisted clients in resolving tax situations totaling greater than $1 million.

Brad also has over 20 years of experience developing security solutions for small and large global organizations and was recently awarded one of only five NSA NCAE-C scholarships from the Department of Defense for his PhD dissertation work on the security of blockchain, cryptocurrency, and financial systems. He also serves as a professor at the University of Pittsburgh with a focus on cybersecurity and information systems, teaching courses at both the undergraduate and graduate levels.

Brad is a nationally sought-a[er speaker on tax topics, blockchain, ethics, and cybersecurity, finding a balance between operational efficiencies and ensuring information integrity. His extensive work in data breach mi/ga/on and recovery has awarded him the label of an industry expert in the security of accounting finance systems.

Brad is the 2023 Tax Professional of the Year, awarded by the National Association of Tax Professionals. He was nominated, voted on, and selected out of a membership of over 24,000 individuals for his dedication to ongoing education, outreach to new and younger members, and focus on trying to increase the overall effectiveness of tax professionals.

Matt Metras, EA Matt Metras, EA

Matt Metras, EA is the owner of MDM Financial Services in Irondequoit, NY. He has been practicing since 2003 and specializes in bookkeeping and taxation for cryptocurrency clients. He is a cofounder of the InCite Tax Community. He has instructed on Cryptocurrency Taxation for the National Association of Enrolled Agents, the National Association of Tax Professionals, The American Institute of Certified Tax Planners, and many other organizations. Additionally, he is a contributing writer for thinkoutsidethetaxbox.com. Matt is also a passionate community advocate and just completed two terms as the President of his local Board of Education.

Victoria Ramirez, Technical Advisor to the Advocate Taxpayers' Rights Advocate's Office Victoria Ramirez, Technical Advisor to the Advocate Taxpayers' Rights Advocate's Office

Victoria Ramirez has been with the Franchise Tax Board (FTB) for over six years and works as a technical advisor to FTB’s Taxpayer Advocate to solve taxpayers’ and tax professionals’ complex and sensitive tax inquiries. She previously worked as a tax manager at KPMG before joining FTB in 2018. This experience provided her with a unique perspective on how FTB and the tax practitioner community collaborate to solve tax matters. In addition, she has gained experience in FTB’s Audit Division, Public Affairs Office, and most recently as manager of FTB’s Legislative Office. Victoria also represented the State of California in 2022 as a member of the IRS’ Taxpayer Advocacy Panel where she volunteered her time to improve IRS services and customer experience. Victoria holds a master’s degree in taxation from Golden Gate University, bachelor’s degrees in accounting and Spanish, and a CPA license.

Ryan Reichert, EA, CFP

Ryan Reichert is an Enrolled Agent and Certified Financial Planner practicing in Coronado, California. Don’t let his young looks fool you; when it comes to tax, there are few as enthusiastic as him. Ryan spends his days reading tax law and speaking with the most brilliant tax minds across the country -- all to distill the law down into working concepts you can apply in your practice. His dynamic seminars help attendees stay engaged while he goes beyond the law to show you things you may not have thought possible.

Ryan is out on the road for most of the year teaching for his education organization, Brass Tax Presentations, but he is also a firm believer in practicing what he preaches. His niche focuses on businesses and their owners to ensure maximum tax efficiency. Ryan also provides consulting services to tax professionals all over the country on specialized issues, including the Employee Retention Credit.

Jane Ryder, EA, CPA Jane Ryder, EA, CPA

Jane Ryder, EA, CPA has been providing tax preparation, accounting services, and tax collection resolution services since 1980. She runs her San Diego CPA firm and writes and speaks on many income tax, business compliance, and accounting topics. Jane has a business-centric practice, preparing and consulting on tax, accounting, and compliance matters for Corporations, S-corporations, LLCs, Partnerships, and Trusts. She also specializes in IRS and state agencies' collection problems, payment plans, audit representation, audit appeals, offers in compromise, and other compliance-related issues. She earned a BS in Business Administration (Accounting) from SDSU and is currently licensed with the California State Board of Accountancy and admitted to practice before the Internal Revenue Service as an Enrolled Agent.

Claudia Stanley, CPA, EA Claudia Stanley, CPA, EA

Claudia Stanley, CPA is a graduate of California State University, Fresno, and serves as treasurer of the California Society of Tax Consultants, as education chair of the Central California Chapter of Enrolled Agents, and as treasurer of Fresno’s local chapter of American Business Women’s Association. Claudia is a long-time member of CSTC. In 2016 she was named member of the year of the Central Valley Chapter of CSTC and in 2001 she was named one of the Top Ten Women of the Year in the nation by the American Business Women’s Association. She frequently speaks on various tax topics.

Josh Youngblood, EA Josh Youngblood, EA

Josh is the founder of The Youngblood Group. Over the last ten years, Josh has worked with individuals and small business taxpayers. He is an Enrolled Agent (EA), a Certified Tax Resolution Specialist (CTRS), a Certified Real Estate Tax Strategist (CRETS), National Tax Practice Institute (NTPI) Fellow, and ISC2 Certified in Cybersecurity. With a keen interest in quality continuing education, both as a learner and an educator, Josh has conducted tax courses on topics ranging from ethics to cybersecurity.

In addition, combining his almost 30 years of IT experience with his love of all things tech and tax, Josh enjoys writing and teaching about technology and various tax topics. Josh is also a contributing writer for Think Outside the Tax Box and author of the Josh & Taxes newsletter, which combines his love of tax and technology.

Active in the tax community, Josh serves on the Government Relations committee for the NAEA and is a member of ASTPS, NATP, NYSSEA, CSEA, and the North Texas LGBT Chamber of Commerce. Outside of work, he enjoys family time and traveling.

About our 2025 Sponsors and Exhibitors

Frequently Asked Questions

Q: How many CPE's are the sessions worth for a CPA? Do the Federal Law hours apply?

A: Yes! Since CPA is a national designation, any Federal tax law/federal update/ethics hours DO apply to CPA CPEs. Only the CA-designated hours won't apply as that is for CTEC only.

Q: What handouts are available?

A: Each registrant will receive at check-in a USB thumb drive containing the electronic handouts provided by the speakers in advance. If there are any changes to the handouts, or if a speaker does not submit handouts in advance, after the conclusion of the Symposium an email will be sent containing a link to a CSTC webpage with the final handouts posted. They will not be emailed during the Symposium. Attendees may choose to print sections/pages from the USB on-site at the Symposium using the hotel business center or printer of their choice. Alternatively, you can pre-order a printed copy of all session handouts (as provided in advance by the speakers) in a bound, tabbed book format for $200. Deadline to order is May 30.

Q: What if I want to change a session after I have registered?

A: No problem! CE reporting will be completed based on the in-person sign-in sheets, so attendees are able to change their session onsite.

Q: What is the maximum CPE I can get from the Summer Symposium?

A: An attendee can earn up to 24 total hours by attending the sessions each day. The type of hours will vary depending on the attendee's choice of which courses to attend.

The Symposium presentations have been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

|

Patty Barron, EA

Patty Barron, EA LG Brooks, EA, CTRS

LG Brooks, EA, CTRS Tom Gorczynski, EA, USTCP

Tom Gorczynski, EA, USTCP Shannon Hall, EA

Shannon Hall, EA David Hilliard, EA, NTPI Fellow

David Hilliard, EA, NTPI Fellow Brad Messner, EA

Brad Messner, EA Matt Metras, EA

Matt Metras, EA

Jane Ryder, EA, CPA

Jane Ryder, EA, CPA Claudia Stanley, CPA, EA

Claudia Stanley, CPA, EA