|

CSTC's 2026 SUMMER TAX SYMPOSIUM

June 7-10, 2026

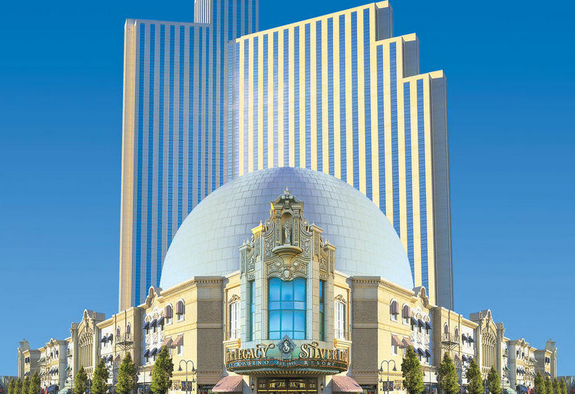

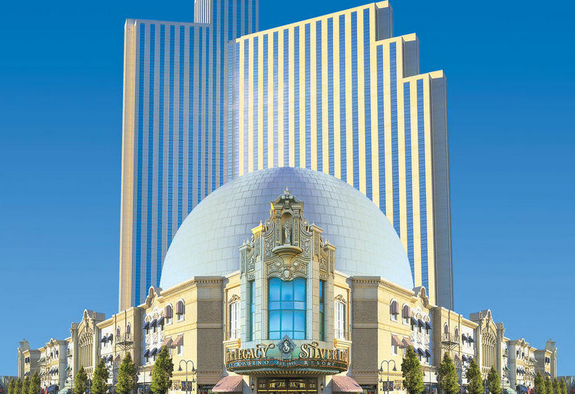

Silver Legacy Resort Casino

Reno, Nevada

The California Society of Tax Consultants, Inc. (CSTC) has been a nonprofit organization dedicated to supporting tax professionals across California since 1966 (formerly known as ISTC). CSTC is committed to providing high-quality education and exclusive member benefits. Whether you're a bookkeeper, accountant, CRTP, Enrolled Agent, or CPA, CSTC has something valuable to offer.

Our programs cover a wide range of tax topics, all approved for CTEC, EA, and CPA credit. Did you know you can earn all your CTEC credits for the year at the Symposium? That’s right—federal, update, ethics, and California hours, all in one event!

And guess what? The popular Lunch and Learn sessions are back! Your registration includes both breakfast and lunch each day of the event.

With an outstanding lineup of speakers and topics, there’s something for everyone, whether you’re a beginner or a seasoned tax preparer.

We can’t wait to see you in Reno! The CSTC Summer Tax Symposium is an event you won’t want to miss!

Quick Links

INTERESTED IN BECOMING A SPONSOR OR EXHIBITOR?

CSTC offers a variety of sponsorship, exhibition, and advertising opportunities tailored to help your company or firm gain prominent visibility, showcase new products and services, and significantly increase exposure. Whether you're showcasing something new or looking to reach a wider audience, our team will customize a sponsorship package to meet your unique marketing needs.

CSTC MEMBER MEMORIAL SCHOLARSHIP

CLICK HERE TO LEARN MORE!

OVERVIEW

The CSTC Symposium Memorial Scholarship offers financial support to cover the registration fee for CSTC members attending the 2026 Summer Symposium. Created in memory of Eva Rosenberg and Nikki LeBrun, two impactful CSTC leaders, the scholarship allows CSTC Chapters and individuals to contribute funds in their honor to support fellow members.

Summer Symposium Schedule-at-a-Glance

| |

Sunday, June 7, 2026

|

| 3:00 PM to 5:00 PM |

Registration Open; Exhibitor Set-up |

| 5:30 PM to 6:00 PM |

Welcome Reception for First-Time Attendees |

| 6:00 PM to 7:00 PM |

Welcome Reception (light appetizers will be served)

This event is family-friendly.

(Included with full registration. Guest registration for this event is $125)

|

| |

Monday, June 8, 2026

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote Session: IRS Keynote Session

Speaker: TBA

|

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: The Entity – Basics of Business Returns

Speaker: Shannon Hall, EA

|

| |

Track Two: There’s No Place Like College: Tax Planning for Education

Speaker: Brad Messner, EA

|

| |

Track Three: QBI Deduction Refresher & Update!

Speaker: Jane Ryder, EA, CPA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: 2026 Digital Asset Tax Update

Speaker: Matt Metras, EA

|

| |

Track Two: You think you know California Residency? Sure, and Dorothy thought she was in Kansas

Speaker: Patricia Barron, EA

|

| |

Track Three: Navigating Rentals & Passive Activity Losses

Speaker: Natalie Kolodij, EA, CRETS

|

| 12:00 PM to 1:20 PM |

Lunch and Learn:

No CE Offered for this Course

|

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Short-Term Rentals: Fact from Fiction

Speaker: Natalie Kolodij, EA, CRETS |

| |

Track Two: Practical Digital Asset Reporting - How to make the most of software

Speaker: Matt Metras, EA |

| |

Track Three: California Individual Tax Update

Speaker: Patricia Barron, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Individual Tax Update

Speaker: Tom Gorczynski, EA, USTCP |

| 5:00 PM to 6:30 PM |

Reception with Exhibitors |

| |

Tuesday, June 9, 2026

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Breakfast Keynote: FTB Keynote

Speaker: TBA

|

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: Click Your Heels and Automate: AI for Estimated Tax Projections

Speaker: Brad Messner, EA

|

| |

Track Two: Dependency In-Depth

Speaker: Shannon Hall, EA

|

| |

Track Three: Taming the Flying Monkeys: Effectively Responding to IRS Notices

Speaker: Josh Youngblood, EA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Filing Status: Rules and Planning

Speaker: Tom Gorczynski, EA, USTCP

|

| |

Track Two: There’s No Place Like Relief: Understanding Innocent Spouse Rules

Speaker: Josh Youngblood, EA

|

| |

Track Three: Tax & Compliance for Not-for-Profit Organizations Part One

Speaker: Veronica Marelli, EA

|

| 12:00 PM to 1:20 PM |

2026 Annual Business Meeting and Awards Ceremony Luncheon

(Included with registration) |

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Tax & Compliance for Not-for-Profit Organizations Part Two

Speaker: Veronica Marelli, EA

|

| |

Track Two: Sale of A Residence

Speaker: Tom Gorczynski, EA, USTCP

|

| |

Track Three: Farming: Alfalfa to Zebras to Deadly Poppies

Speaker: Brad Messner, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Business Tax Update

Speaker: Jane Ryder, EA, CPA

|

| |

Wednesday, June 10, 2026

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 8:20 AM to 10:05 AM |

Breakfast Keynote Session: Closing a Practice

Speaker: Tom Gorczynski, EA, USTCP, Josh Youngblood, EA, and Shannon Hall, EA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: GIG Economy Tax Compliance, Tax Savings and Form 1099-K

Speaker: Jane Ryder, EA, CPA

|

| |

Track Two: Estate Planning After the OBBBA

Speaker: Frank Acuña, Attorney at Law |

| |

Track Three: Summary Judgement: Lessons Learned from the US Tax Court

Speaker: Matt Metras, EA

|

| 12:00 PM to 1:20 PM |

Lunch and Learn

No CE Offered for this Course

|

| 1:20 PM to 3:00 PM |

General Session: Stump the Tax Experts

Speaker: Speaker Panel |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Assisting Clients with Estate Planning Needs - Ethically!

Speaker: Frank Acuña, Attorney at Law

|

| 5:15 PM |

Grand Prize Drawing |

Registration Information and Fees

|

Category

|

Fee by February 28, 2026

|

Fee by April 30, 2026

|

Fee After April 30, 2026

|

|

Members

|

$899

|

$949

|

$999

|

|

Staff of Members

|

$924

|

$974

|

$1,024

|

|

Non-Members

|

$1,124

|

$1,174

|

$1,224

|

|

Sunday Night Reception Guest Tickets (appetizers served)

|

$125

|

$125

|

$125

|

|

Guest Registration Fee

|

$500

|

$500

|

$500

|

Attendee Registration Fees Include: Educational sessions and materials, including a USB drive with electronic handouts, daily breakfasts, lunches, refreshment breaks, and a Sunday evening reception. Registrants will also receive the electronic handouts via email after the Symposium.

Guest Registration Fee Includes: All meals, food breaks, and receptions. Continuing education is not included.

Optional Printed Handouts: $250 for a complete set of session handouts (covering all sessions, regardless of your selections). The materials will be in book format and provided at check-in.

The deadline to order printed handouts is May 27, 2026. See FAQ's for more details.

Cancellation Policy: Written/emailed requests for a registration fee refund will be accepted until May 8, 2026. A $200 administrative fee will be deducted from all refunds. No refund of any kind will be given if a written cancellation notice is received after May 8, 2026. There are no refunds for no-show registrants.

Hotel Information

Silver Legacy Resort and Casino

407 North Virginia Street

Reno, Nevada 89501

1-800-687-8733

http://www.silverlegacyreno.com/

Check-in time is 3:00 PM and check-out time is 12:00 PM.

$62 plus tax/fees and a resort fee of $25 per guestroom per night, single or double occupancy until block sells out Sunday through Wednesday night.

A daily resort fee of $25 per room, per night plus the current occupancy room tax will be charged in addition to the room rates set forth above. This fee includes:

• In-room Keurig® coffee maker with Starbucks® K-Cup® Pods

• Unlimited local and toll-free calls

• Refrigerator and in-room safe*

• Airport shuttle service and self-parking

• Access to the all-new Fitness Center inside The Spa at Silver Legacy

• Printing of boarding passes, notary services, and safety deposit box access.

Located in the heart of the Biggest Little City, Silver Legacy Resort Casino offers everything under one roof. This modern Reno hotel has restaurants, big-name entertainment and an action-packed casino. Silver Legacy also has gorgeous mountain views and is a quick drive from Lake Tahoe.

Session Descriptions

Breakfast Keynote: IRS Update - More information coming soon

Speaker:

Session Description:

1 Federal Update hour

IRS:

CTEC:

Knowledge Level: Update (Information on new tax laws)

The Entity – Basics of Business Returns

Speaker: Shannon Hall, EA

Session Description: Do business returns scare you more than things that go bump in the night? Never fear! We’ll take the mystery out of the basics of business returns so you have the confidence explore this fun and lucrative aspect of tax preparation. Learn the differences between the main entity types, discuss pros and cons of each, and look at the tax advantages available to business owners.

Learning Objectives:

#1: Identify the main business entity types and understand the primary differences between them

#2: Discuss the advantages and disadvantages of each type

#3: Review ethical issues surrounding advising clients on entity selection

1 Federal Law hour

IRS #: 18QC1-T-02226-25-I

CTEC #: 1000-CE-05706

Knowledge Level: Intermediate (Basic knowledge helpful)

There’s No Place Like College: Tax Planning for Education

Speaker: Brad Messner, EA

Session Description: Education remains one of the largest financial decisions families face. This session reviews planning opportunities including 529 savings, AOTC Credits, tuition deductions, student loan repayment, and more. We’ll learn how to maximize benefits, avoid pitfalls, and support clients through every stage of education financing.

Learning Objectives:

#1: Identify and compare key education planning tools such as 529 plans, the American Opportunity Tax Credit, and tuition deductions to determine the most advantageous options for clients

#2: Properly account for education expenses, student loan repayment, and related deductions or credits to ensure compliance while optimizing current year and long-term educational goals

#3: Design holistic strategies to help clients maximize tax benefits, minimize risks, and make informed decisions at every stage of education

1 Federal Law hour

IRS: 18QC1-T-02227-25-I

CTEC: 1000-CE-05707

Knowledge Level: Intermediate (Basic knowledge helpful)

QBI Deduction Refresher & Update!

Speaker: Jane Ryder, EA, CPA

Session Description: Maximizing the QBI deduction, 199A, includes planning, structuring and strategizing for different types of businesses, SSTBs and entities, S corps, Partnerships, Sole Proprietorships, rentals, related entities and some trusts. Evaluating and comparing options including the increased phase out range and new minimum QBI deduction provision from OBBBA offers substantial tax savings.

Learning Objectives:

#1: Develop skills to maximize QBI for S Corps, Partnerships, Sole Proprietors, Rentals, & trusts.

#2: Learn QBI strategies related to compensation, health insurance, self-rental, related businesses, multiple income streams, global income and more.

#3: Understand the new minimum QBI deduction from OBBBA.

1 Federal Update hour

IRS #: 18QC1-U-02228-25-I

CTEC #: 1000-CE-05708

Knowledge Level: Update (Information on new tax laws)

2026 Digital Asset Tax Update

Speaker: Matt Metras, EA

Session Description: The taxation of digital assets is a fast-paced and quickly changing environment. We’ll review what’s new in the DA world and the tax implications that go along with it. In 2024 alone, Treasury and the IRS issued over 400 pages of new crypto guidance. New basis accounting went into effect Jan 1, 2025. Make sure you and your clients are up to date. Learning Objectives: Review pre-existing IRS Guidance on digital assetsEvaluate recent IRS Guidance related to digital assetsIdentify client situations lacking defined guidanceAnalyze client situations to apply taxation principles where no guidance exists

Learning Objectives:

#1: Review pre-existing IRS Guidance on digital assets

#2: Evaluate recent IRS Guidance related to digital assets

#3: Identify client situations lacking defined guidance

#4: Analyze client situations to apply taxation principles where no guidance exists

2 Federal Law hours

IRS #: 18QC1-T-02229-25-I

CTEC #: 1000-CE-05709

Knowledge level: Intermediate (Basic knowledge helpful)

You think you know California Residency? Sure, and Dorothy thought she was in Kansas

Speaker: Patricia Barron, EA

Session Description: It is important for California income tax purposes that you make an accurate determination of your residency status. We will review how to determine your residency status as Resident, Non-Resident or Part-Year Resident and how to report the income and credits accurately. We will review tax law and court cases that help us determine residency and appropriate allocation of income and state tax, including work from home situations, income sourcing, RDP issues and unique residency issues for military personnel and spouse. One case to review - The Ruby Slippers - and what if the Land of Oz was the Land of California ??

Learning Objectives:

#1: How to accurately determine residency and part-year residency issues and allocations of income.

#2: What are the considerations for out of state workers, military personnel and California residents that are working out of state.

#3: When do you stop being a California resident; what is involved in a FTB residency audit and how will they determine if you should be paying California tax.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-05710

Knowledge level: Intermediate (Basic knowledge helpful)

Navigating Rentals & Passive Activity Losses

Speaker: Natalie Kolodij, EA, CRETS

Session Description: This session will focus on how passive activity rules impact rental real estate reporting. We will walk through determining when a rental activity is passive or non-passive, navigating the passive activity limitations, qualifications of real estate professional status, and understanding what happens to disallowed passive losses when an activity is sold, exchanged, or converted to non-passive.

Learning Objectives:

#1: Determine when a rental activity is passive or non-passive.

#2: Understanding the passive activity rules, limitations, and planning opportunities to utilize disallowed passive activity losses.

#3: Have a high level understanding of real estate professional status and connected benefits and considerations.

2 Federal Law hours

IRS #: 18QC1-T-02230-25-I

CTEC #: 1000-CE-05711

Knowledge Level: Intermediate (Basic knowledge helpful)

Lunch and Learn: More information coming soon

No CE offered for this course

Short-Term Rentals: Fact from Fiction

Speaker: Natalie Kolodij, EA, CRETS

Session Description: Short-term rentals continue to be popular with taxpayers and misunderstood by tax professionals. In this session we will walk through the correct reporting of short-term rentals while also addressing some of the common misunderstandings. You will gain a clear understanding of when these activities belong on Schedule E vs. Schedule C, how to correctly apply depreciation, and when they are subject to self-employment taxes. Lastly, we will walk through what is frequently referred to as the “short-term rental loophole” addressing the requirements for a short-term rental to be non-passive and what potential tax benefits this unlocks for your clients.

Learning Objectives:

#1: Understanding when a short-term rental is non-passive and can qualify for the commonly mentioned "short-term rental loophole".

#2: Knowing when a short-term rental is reported on Schedule C vs. Schedule E and when self-employment tax applies.

#3: Addressing depreciation reporting including depreciable life, properties with both STR and LTR units, and the impacts of converting a property to or from long-term use.

2 Federal Law hours

IRS #: 18QC1-T-02231-25-I

CTEC #: 1000-CE-05712

Knowledge Level: Intermediate (Basic knowledge helpful)

Practical Digital Asset Reporting - How to make the most of software

Speaker: Matt Metras, EA

Session Description: A practical investigation into how to properly report cryptocurrency transactions for taxpayers that don't have 3rd party information returns, as well as those that do. We will review general digital asset taxation and guidance and then apply that knowledge in an interactive exercise. We will take a group of raw crypto transactions, identify the taxable events and reportable income and populate a 1040 with them. We will utilize crypto tax software to create a completed 8949 from source documents.

Learning Objectives:

#1: Review general cryptocurrency taxation

#2: Be able to identify and categorize raw transactions. Be able to evaluate positions with unclear guidance.

#3: Be able to produce a completed 1040 from raw crypto data.

2 Federal Law hours

IRS #: 18QC1-T-02232-25-I

CTEC #: 1000-CE-05713

Knowledge Level: Intermediate (Basic knowledge helpful)

California Individual Tax Update

Speaker: Patricia Barron, EA

Session Description: We will review the latest recent changes in California tax laws including Ca SB-711 conformity issues related to Federal tax law and non-conformity on many issues. Also, we will review recently passed California tax legislation effecting income and deductions and discuss what income should be sourced to California, compliance issues and various California Credits.

Learning Objectives:

#1: Attendees will gain a better understanding of both the conformity issues that were brought in line with Federal tax laws and the ones that are still different.

#2: A review of both new and existing California credits because many credits are overlooked and under claimed.

#3: Learn what's changing for California individual taxes.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-05714

Knowledge Level: Update (Information on new tax laws)

Afternoon Keynote: Individual Tax Update

Speaker: Tom Gorczynski, EA, USTCP

Session Description: This course reviews key tax law changes and trends that impact the taxation of individuals for tax years 2025 and 2026. It will also cover best practices for the tax practice and tax planning opportunities related to these changes and trends.

Learning Objectives:

#1: Summarize how new tax legislation enacted by Congress impacts the taxation of individuals.

#2: Demonstrate how new IRS guidance impacts individual tax provisions.

#3: Describe how the existing tax law applies to new trends applicable to individuals.

2 Federal Update hours

IRS #: 18QC1-U-02233-25-I

CTEC #: 1000-CE-05715

Knowledge level: Update (Information on new tax laws)

Breakfast Keynote: FTB Update - More information coming soon

Speaker:

Session Description:

1 California hour

IRS:

CTEC:

Knowledge Level:

Click Your Heels and Automate: AI for Estimated Tax Projections

Speaker: Brad Messner, EA

Session Description: Quarterly estimated taxes can be stressful and time consuming. Discover how AI-driven planning can project income, automate calculations, and minimize surprises. Learn how to integrate AI into your firm operations to improve accuracy, save time, and create meaningful efficiencies in year-round tax planning while reducing errors.

Learning Objectives:

#1: Explain how AI tools can project income, estimate quarterly taxes, and identify potential tax liabilities before filing deadlines but also recognize the limitations of AI systems

#2: Implement AI-based systems that automate tax calculations, streamline client data collection, and reduce the manual workload associated with quarterly estimated payments

#3: Develop strategies to embed AI into your firm’s broader tax planning processes to improve accuracy, save time, and minimize human error

1 Federal Law hour

IRS #: 18QC1-T-02234-25-I

CTEC #: 1000-CE-05716

Knowledge level: Intermediate (Basic knowledge helpful)

Dependency In-Depth

Speaker: Shannon Hall, EA

Session Description: The topic of dependency can seem simple enough, but lurking just beneath the surface is a seedy underbelly of uncertainty. We’re on the case to solve the mysteries of dependency with this in-depth investigation into common (and uncommon) dependency situations. Can there be two heads to a household? Just what IS a temporary absence? What impact does married filing separate have on dependency benefits?Unveil the answers to these questions and more!

Learning Objectives:

#1: Determine qualifications for claiming dependents either as Qualifying Child or Qualifying Relative

#2: Explore requirements and implications of dependent related filing statuses

#3: Understand dependent related credits and deductions

1 Federal Law hour

IRS #: 18QC1-T-02235-25-I

CTEC #: 1000-CE-05717

Knowledge level: Intermediate (Basic knowledge helpful)

Taming the Flying Monkeys: Effectively Responding to IRS Notices

Speaker: Josh Youngblood, EA

Session Description: When clients receive an IRS notice, panic often sets in—and tax professionals are left to clean up the chaos. In this fast-paced session, we’ll break down the most common types of IRS notices and teach you how to respond strategically and confidently. You’ll learn what to look for, what to avoid, and how to craft professional, persuasive responses that keep cases from escalating.Using a touch of Wizard of Oz humor, we’ll turn those intimidating “flying monkeys” of the IRS into manageable messengers. You’ll leave with practical templates, workflow tips, and an understanding of how to protect both your client and your sanity when dealing with the IRS.

Learning Objectives:

#1: Identify and interpret the most common IRS notices to determine their purpose, level of urgency, and appropriate next steps.

#2: Craft clear, effective responses that address the IRS’s concerns, protect client rights, and reduce the risk of escalation.

#3: Develop a repeatable workflow for tracking, documenting, and following up on IRS correspondence to improve efficiency and client communication.

1 Federal Law hour

IRS #: 18QC1-T-02236-25-I

CTEC #: 1000-CE-05718

Knowledge level: Intermediate (Basic knowledge helpful)

Filing Status: Rules and Planning

Speaker: Tom Gorczynski, EA, USTCP

Session Description: One of the key positions taken on an individual tax return is the filing status, whichimpacts not only the tax brackets but also what deductions and credits the taxpayer can claim. Joint versus separate returns for married taxpayers will be reviewed in-depth, as well as the requirements for the head of household and surviving spouse/qualifying widower statuses.

Learning Objectives:

#1: Explain how an individual qualifies for the head of household filing status.

#2: Describe the rules related to making a joint return election for married individuals.

#3: Compare and contrast the joint and separate filing statuses for married individuals and when each is preferable.

2 Federal Law hours

IRS #: 18QC1-T-02237-25-I

CTEC #: 1000-CE-05719

Knowledge level: Intermediate (Basic knowledge helpful)

There’s No Place Like Relief: Understanding Innocent Spouse Rules

Speaker: Josh Youngblood, EA

Session Description: When a taxpayer is swept into the tax troubles of a spouse or ex-spouse, Innocent Spouse Relief can be the path home. In this session, we’ll explore the three types of relief: Innocent Spouse, Separation of Liability, and Equitable Relief, and the key differences between them. Through real-world examples, we’ll discuss eligibility criteria, documentation requirements, and strategies to present a strong case to the IRS.With a balanced mix of technical guidance and practical insight, you’ll learn how to evaluate your client’s situation, identify the right type of relief, and advocate effectively. By the end, you’ll be ready to help clients click their heels three times and find their way back to financial fairness.

Learning Objectives:

#1: Differentiate between the three types of Innocent Spouse Relief and determine which applies based on the taxpayer’s circumstances.

#2: Prepare and support a strong Innocent Spouse claim through accurate documentation, effective client interviews, and awareness of common pitfalls.

#3: Guide clients through the Innocent Spouse process by setting expectations, understanding timelines, and communicating effectively with the IRS.

2 Federal Law hours

IRS #: 18QC1-T-02238-25-I

CTEC #: 1000-CE-05720

Knowledge level: Intermediate (Basic knowledge helpful)

Tax & Compliance for Not-for-Profit Organizations Part One

Speaker: Veronica Marelli, EA

Session Description: This course provides accounting professionals, advisors, and nonprofit leaders with a clear and practical understanding of the complete lifecycle of a nonprofit organization. From initial formation through major organizational milestones, participants will learn the legal, financial, and compliance-related responsibilities that shape each phase of a nonprofit’s development. This comprehensive overview helps practitioners better support their nonprofit clients in remaining compliant, sustainable, and mission-focused. The course begins with Stage 1 – Starting Out, offering an exploration of the foundational steps required to create a nonprofit entity. Participants will learn how organizations establish legal structure, define their mission, draft governing documents, and prepare for the regulatory obligations ahead.Next, in Stage 2 – Applying for Exemption, the course explains the IRS application process for tax-exempt status, including Form 1023, Form 1023-EZ, eligibility requirements, timelines, and common pitfalls. Attendees will understand how to guide organizations through the exemption process and avoid delays or denials. Stage 3 – Required Filings focuses on annual federal and state filing obligations, covering Form 990-series returns, state charitable registrations, and other recurring reporting requirements. The section emphasizes the importance of accurate financial reporting and the consequences of late or incomplete filings. In Stage 4 – Ongoing Compliance, the course delves into the long-term operational responsibilities of tax-exempt entities. Topics include governance practices, maintaining public charity status, unrelated business income considerations, internal controls, donor acknowledgment rules, and financial stewardship. Participants will gain insight into how nonprofits can remain compliant year after year. Finally, Stage 5 – Significant Events examines major organizational changes that may impact tax-exempt status or introduce additional reporting requirements. This includes dissolution, mergers, substantial program changes, large donations, compensation issues, and IRS examinations. The course highlights how these events should be evaluated and documented to ensure continued compliance. By the end of this program, participants will have a complete roadmap for understanding the lifecycle of a nonprofit organization, equipping them with the knowledge to provide informed, proactive guidance to nonprofit clients and boards.

Learning Objectives:

#1: Identify and describe the five stages of the nonprofit organization lifecycle. Stage 1 – Starting Out Stage 2 – Applying for Exemption Stage 3 – Required Filings Stage 4 – Ongoing Compliance Stage 5 - Significant Events

#2: Explain the legal and organizational requirements involved in forming a nonprofit entity.

#3: Recognize required annual filings, including Form 990-series returns and state-level reporting.

2 Federal Law hours

IRS #: 18QC1-T-02239-25-I

CTEC #: 1000-CE-05721

Knowledge level: Intermediate (Basic knowledge helpful)

Tax & Compliance for Not-for-Profit Organizations Part Two

Speaker: Veronica Marelli, EA

Session Description: This 2-hour CPE course gives accountants, advisors, and nonprofit leaders a practical overview of core compliance for not-for-profit organizations. It covers federal Form 990 filing requirements, key California state filings, and proper nonprofit dissolution procedures. The program reviews the Form 990 series, schedules, financial disclosures, and common errors. It explains how Form 990 serves as both a tax return and a public transparency document. The course also details California filings like Form 199, RRF-1, and charitable solicitation rules, plus the steps for dissolving a nonprofit, including final returns and asset distribution. Participants gain essential compliance knowledge for supporting nonprofits.

Learning Objectives:

#1: How to properly prepare and file the Form 990 seriesParticipants will understand which version of the Form 990 applies to a specific organization, key schedules, governance disclosures, and best practices to avoid IRS scrutiny or penalties.

#2: The required California filings for nonprofit organizationsAttendees will gain clarity on state-level registration and reporting, including the RRF-1, Form 199, charitable solicitation rules, and how to maintain compliance with the California Attorney General and Franchise Tax Board.

#3: The correct legal and regulatory steps for nonprofit dissolutionParticipants will learn the full dissolution process—from board resolutions to asset distribution rules, state and federal notifications, and the filing of final returns.

1 Federal Law hour, 1 California hour

IRS #: 18QC1-T-02240-25-I

CTEC #: 1000-CE-05722

Knowledge level: Intermediate (Basic knowledge helpful)

Sale of A Residence

Speaker: Tom Gorczynski, EA, USTCP

Session Description: One of the most common financial transactions is the sale of a primary residence. This course will go through the transaction from start to finish, from calculating the initial basis, amount realized, total gain or loss, and any available §121 exclusion. Possible tax planning strategies available will also be reviewed.

Learning Objectives:

#1: Calculate the amount realized, adjusted basis, and gain or loss from the sale of a primary residence.

#2: Calculate the §121 exclusion available for gain from the primary residence.

#3: Explain the tax consequences upon sale from business or rental use of a primary residence.

2 Federal Law hours

IRS #: 18QC1-T-02241-25-I

CTEC #: 1000-CE-05723

Knowledge level: Intermediate (Basic knowledge helpful)

Farming: Alfalfa to Zebras to Deadly Poppies

Speaker: Brad Messner, EA

Session Description: Farming is one of the more complex (but fun!) areas in tax. This session reviews regs for traditional crops, livestock, and even unusual agricultural ventures. We’ll explore depreciation, credits, subsidies, and planning strategies that help farmers of all types, from alfalfa growers to zebra ranchers.

Learning Objectives:

#1: Recognize and apply federal tax rules to comply with traditional and nontraditional farming activities, including crops, livestock, and specialty agricultural adventures

#2: Calculate and leverage unique depreciation opportunities and identify available agricultural tax credits or incentives across a range of farm business models

#3: Design effective tax strategies tailored to diverse farm operations, helping clients minimize tax burdens, maximize available incentives, and plan for long-term sustainability

2 Federal Law hours

IRS #: 18QC1-T-02242-25-I

CTEC #: 1000-CE-05724

Knowledge level: Intermediate (Basic knowledge helpful)

Afternoon Keynote: Business Tax Update

Speaker: Jane Ryder, EA, CPA

Session Description: This course reviews federal business and rental tax law changes for 2025 & 2026 plus OBBBA provisions. For business tax: OBBBA provisions: Deductions for Tips and Overtime for the self-employed, QBI, 100% Bonus Depreciation, 179 depreciation, R & D expensing, PTET, Energy Credits for business and rentals, etc. Plus new IRS guidance on business compliance, tax savings, and form changes for 2025 and 2026. We'll also cover updates to the federal disaster loss deductions for business.

Learning Objectives:

#1: Review 2025 & 2026 federal tax updates & OBBBA including any late breaking legislation.

#2: Learn expected rules and processes for implementing any new tax law changes.

#3: Understand the effect of these changes for 2025 and future years.

2 Federal Update hours

IRS #: 18QC1-U-02243-25-I

CTEC #: 1000-CE-05725

Knowledge level: Update (Information on new tax laws)

Breakfast Keynote: Closing a Practice

Speakers: Tom Gorczynski, EA, USTCP, Josh Youngblood, EA, and Shannon Hall, EA

Session Description: Proposed changes to Circular 230 include requirements for succession planning for tax practices. In this panel discussion, we will review best practices when it comes time to close up shop, as well as the different ways to structure a sale and the tax implications of them. Whether you’re looking to downsize, retire, or take on new businesses, this session is for you!

Learning Objectives:

#1: Understand responsibilities around data security when transferring clients in the sale of a practice

#2: Review asset versus stock sale and the tax implications for buyer and seller including Form 8594 asset allocation

#3: Discuss steps required to wind down a business entity

2 Federal Law hours

IRS #: 18QC1-T-02244-25-I

CTEC #: 1000-CE-05726

Knowledge level: Intermediate (Basic knowledge helpful)

GIG Economy Tax Compliance, Tax Savings and Form 1099-K

Speaker: Jane Ryder, EA, CPA

Session Description: The GIG economy is here to stay; drivers, deliveries, short term rentals, home rental, side-services such as pet sitting, food trucks, remote office work, handyman, on-line sales, etc. Accurate compliance reporting for this side income is critical and unique IRS rules and regs for auto expense, travel, home office, shared rentals, etc. will save tax dollars too. We'll also discuss new Form 1099-K filing requirements and how this may affect our clients.

Learning Objectives:

#1: Learn filing requirements for different GIG Economy income; rentals, driving & delivery, on-line sales, etc.

#2: Understand specific expenses related to the GIG economy, auto expenses, home rental, & more.

#3: Review the latest Form 1099-K guidance and how it affects taxpayers receiving the form, including non-taxable Form 1099-K income.

2 Federal Law hours

IRS #: 18QC1-T-02245-25-I

CTEC #: 1000-CE-05727

Knowledge level: Intermediate (Basic knowledge helpful)

Estate Planning After the OBBBA

Speaker: Frank Acuña, Attorney at Law

Session Description: The "One Big Beautiful Bill Act" was presented as the be-all and end-all of tax reform. But what does it mean, and how should we advise clients now?This course will examine the estate planning strategies which are essential after the OBBBA. We will examine real-life situations and diagnose which estate planning strategies are appropriate to the situation and the tax reporting required by each. This is a "real world" course designed to help you advise your clients!

Learning Objectives:

#1: Overview of the OBBBA from an estate and gift tax perspective.

#2: Review typical estate planning techniques, highlighting client needs after the OBBBA.

#3: Learn to identify which trusts are appropriate for various client situations, and which existing trusts should be modified or scrapped.

2 Federal Update hours

IRS #: 18QC1-U-02246-25-I

CTEC #: 1000-CE-05728

Knowledge level: Intermediate (Basic knowledge helpful)

Summary Judgement: Lessons Learned from the US Tax Court

Speaker: Matt Metras, EA

Session Description: The United States Tax Court handles a vast spectrum of tax cases, from tax protester arguments to determining the validity of Treasury Regulations. Many of these cases come down to practical matters, like how an item was reported on the return. Sometimes small errors result in the taxpayer losing what would be an otherwise allowable deduction. We’ll examine mistakes made by taxpayers (and their tax pros) and review steps practitioners can take to not follow the same path

Learning Objectives:

#1: Review recent cases from the US Tax CourtEvaluate the positions taken on returns in those cases

#2: Identify the underlying tax code related to those positions

#3: Analyze client situations to best advise them to avoid errors made by taxpayers in these cases.

2 Federal Law hours

IRS #: 18QC1-T-02247-25-I

CTEC #: 1000-CE-05729

Knowledge level: Overview (General knowledge of the subject)

Lunch and Learn: More information coming soon

No CE offered for this course

General Session - Stump the Tax Experts

Speaker: Speaker Panel

Session Description: This is a special question-and-answer session with our unique panel of Tax Experts that includes many of our terrific speakers who have agreed to let us test their tax knowledge! Do you have a burning question that is driving you crazy because you cannot find the answer on your own? Did you learn something in one of your classes that needs further explanation for you to understand the tax concept? Questions will be collected during the Symposium.

2 Federal Law hours

IRS #: 18QC1-T-02248-25-I

CTEC #: 1000-CE-05730

Knowledge level: Intermediate (Basic knowledge helpful)

Afternoon Keynote: Assisting Clients with Estate Planning Needs - Ethically!

Speaker: Frank Acuña, Attorney at Law

Session Description: Clients who have strong relationships with their tax professionals want their assistance with estate planning. However, this may create ethical challenges for the tax professional and subject them to accusations of "UPL" (Unauthorized Practice of Law).This course will examine various ways a tax professional may assist clients with estate planning needs without risk of UPL, and the ways a tax professional may be paid for their services legally and appropriately. We will highlight the various tasks involved, and the proper responsibilities of the client, the tax professional, the financial professional, and the attorney. Our hope is that you will find new ways to serve your clients and to increase your tax consulting practice, ethically!

Learning Objectives:

#1: Understand the proper roles of an attorney, tax professional, and financial professional in the estate planning process.

#2: Understand "Unauthorized Practice of Law" and how to avoid liability.

#3: Brainstorm an ethical and profitable estate planning assistance practice for attendees to offer to their clients.

2 Ethics hours

IRS #: 18QC1-E-02249-25-I

CTEC #: 1000-CE-05731

Knowledge level: Intermediate (Basic knowledge helpful)

About the Presenters

Frank Acuña, Attorney at Law Frank Acuña, Attorney at Law

Frank R. Acuña is a founding partner of ACUÑA ❖ REGLI. He is a California State Bar-certified estate planning, trust, and probate law specialist. His practice includes estate planning; inheritance litigation; business succession planning; special needs trusts; and farm, ranch, and vineyard succession planning. Mr. Acuña has taught tax seminars for the National Tax Practice Institute, the California Society of Enrolled Agents, the California Society of Tax Consultants, a number of state and local chapters of the National Association of Enrolled Agents, and the American Institute of Certified Public Accounts. Mr. Acuña also is a featured speaker for the Professional Fiduciary Association of California, the National Guardianship Association, and the California Public Administrators, Public Conservators, and Public Guardians. He advises tax, fiduciary, and real estate professionals throughout the State of California.

Patty Barron, EA Patty Barron, EA

A member of the Orange County CSTC Chapter, Patty currently serves as 1st Vice President/Education Chair. A believer in lifelong learning, she enjoys sharing knowledge and experience with fellow tax professionals. Patty has been preparing taxes since 1992 and has a practice in Fullerton, CA focusing on Individuals and Small Business taxes.

Patty is also a retired 9-1-1 Dispatcher and originally moonlighted as a tax preparer. Believe it or not, the two careers have a lot in common! Her favorite saying is “taxes are about the people, not the math.”

Patty has been a public speaker and presenter in both her career fields. She is a regular presenter at the Orange County Chapter including their annual Tax Update Forum, Tax Preparer Security and California topics. As a 9-1-1 Dispatcher she was a lead trainer for new dispatchers, instructed and certified groups in state computer systems access and did public presentations to Neighborhood Watch events.

Tom Gorczynski, EA, USTCP Tom Gorczynski, EA, USTCP

Thomas A. Gorczynski, EA, USTCP is a nationally recognized speaker and educator on federal tax law matters. He is the author of the Tom Talks Taxes newsletter, the co-author of the PassKey Learning Systems EA Review Series, and co-owner of Compass Tax Educators. He is an Enrolled Agent, a Certified Tax Planner, a National Tax Practice Institute Fellow, and admitted to the bar of the United States Tax Court as a non-attorney.

Shannon Hall, EA Shannon Hall, EA

Shannon Hall, EA, is a tax professional based in Long Beach, CA. Her diverse client base keeps her on the cutting edge of new tax developments. Shannon is a featured speaker for tax societies nationwide and a writer and presenter for Brass Tax Presentations. She holds degrees in both Accounting and Theatre Arts, which aids her in creating captivating and informative tax presentations.

She has served as the First Vice President of CSTC in charge of education for three years, as well as participating on the board of her local chapter in Orange County. Shannon was named CSTC Member of the Year for 2023.

Natalie Kolodij, EA, CRETS Natalie Kolodij, EA, CRETS

Natalie is an IRS Enrolled Agent who has been working exclusively with Real Estate Investors for almost a decade. She is a National Tax Educator, Founder of the Certified Real Estate Tax Strategist Credential, and Co-Founder of the InCite Tax Community. Recent presentations have included “Your Real Estate Tax Questions Answered”, “Short-Term rentals: After the audits”, and “Advanced Real Estate Tax Issues”.

Veronica Marelli, EA

Veronica has a formal education in Accounting and has been an Enrolled Agent for almost 20 years. She is the owner of Tax Resolution Advocates with offices in Temecula California, SLC Utah, and Southern Idaho. Tax Resolution Advocates is a full-service tax firm that specializes in tax problem resolution. She is also a Certified Tax Resolution Specialist.

She has recently added Profit First consulting to her firm. She is approximately one of only 140 tax professionals in the US to become a Profit First Professional. Profit First is an organization dedicated to eradicating entrepreneurial poverty.

Veronica served as 1st Vice President of the California Society of Tax Consultants at the State level. She also served the local North San Diego Chapter as second Vice President for many years. Both of these positions were as the Education Chair. It was her main responsibility to ensure Tax professionals Statewide were trained and up to date on all new State and federal tax laws and changes to the current tax code.

Veronica has a vast amount of experience serving and working on the Board of Directors. She has, or is currently serving on five different boards of Not-for-profit organizations. These organizations have helped our communities by providing shelter for abused women and homeless teenagers, feeding underprivileged children, and the planting of new Christian Churches.

Brad Messner, EA Brad Messner, EA

Brad Messner is a third-generation owner of Messner & Fox, LLC located just outside of Pittsburgh, PA. He is the firm’s first Enrolled Agent and has 25 years of experience specializing in research credits, farming, commercial beverage (wineries, distilleries, and breweries), tech/startups, and corporate tax preparation as well as an in-depth understanding of data security, due diligence, and entity selection. Obtaining complimentary bachelor’s degrees in information systems and business management with a concentration in accounting from the University of Pittsburgh coupled with an MBA with a focus in information systems from the Indiana University of Pennsylvania, Brad has a robust background in accounting, financial systems, and information systems.

Upon the passing of his father in 2009, Brad stepped up to the role of Vice President at Messner & Fox, LLC where he works diligently with their staff providing tax preparation, tax planning, bookkeeping, and payroll services to a client base of several thousand clients across 30+ states and over 8 countries. Bringing

representation services into the firm shortly afterer becoming an Enrolled Agent, Messner & Fox, LLC has assisted clients in resolving tax situations totaling greater than $1 million.

Brad also has over 20 years of experience developing security solutions for small and large global organizations and was recently awarded one of only five NSA NCAE-C scholarships from the Department of Defense for his PhD dissertation work on the security of blockchain, cryptocurrency, and financial systems. He also serves as a professor at the University of Pittsburgh with a focus on cybersecurity and information systems, teaching courses at both the undergraduate and graduate levels.

Brad is a nationally sought-a[er speaker on tax topics, blockchain, ethics, and cybersecurity, finding a balance between operational efficiencies and ensuring information integrity. His extensive work in data breach mi/ga/on and recovery has awarded him the label of an industry expert in the security of accounting finance systems.

Brad is the 2023 Tax Professional of the Year, awarded by the National Association of Tax Professionals. He was nominated, voted on, and selected out of a membership of over 24,000 individuals for his dedication to ongoing education, outreach to new and younger members, and focus on trying to increase the overall effectiveness of tax professionals.

Matt Metras, EA Matt Metras, EA

Matt Metras, EA is the owner of MDM Financial Services in Irondequoit, NY. He has been practicing since 2003 and specializes in bookkeeping and taxation for cryptocurrency clients. He is a cofounder of the InCite Tax Community. He has instructed on Cryptocurrency Taxation for the National Association of Enrolled Agents, the National Association of Tax Professionals, The American Institute of Certified Tax Planners, and many other organizations. Additionally, he is a contributing writer for thinkoutsidethetaxbox.com. Matt is also a passionate community advocate and just completed two terms as the President of his local Board of Education.

Jane Ryder, EA, CPA Jane Ryder, EA, CPA

Jane Ryder, EA, CPA has been providing tax preparation, accounting services, and tax collection resolution services since 1980. She runs her San Diego CPA firm and writes and speaks on many income tax, business compliance, and accounting topics. Jane has a business-centric practice, preparing and consulting on tax, accounting, and compliance matters for Corporations, S-corporations, LLCs, Partnerships, and Trusts. She also specializes in IRS and state agencies' collection problems, payment plans, audit representation, audit appeals, offers in compromise, and other compliance-related issues. She earned a BS in Business Administration (Accounting) from SDSU and is currently licensed with the California State Board of Accountancy and admitted to practice before the Internal Revenue Service as an Enrolled Agent.

Josh Youngblood, EA Josh Youngblood, EA

Josh is the founder of The Youngblood Group. Over the last ten years, Josh has worked with individuals and small business taxpayers. He is an Enrolled Agent (EA), a Certified Tax Resolution Specialist (CTRS), a Certified Real Estate Tax Strategist (CRETS), National Tax Practice Institute (NTPI) Fellow, and ISC2 Certified in Cybersecurity. With a keen interest in quality continuing education, both as a learner and an educator, Josh has conducted tax courses on topics ranging from ethics to cybersecurity.

In addition, combining his almost 30 years of IT experience with his love of all things tech and tax, Josh enjoys writing and teaching about technology and various tax topics. Josh is also a contributing writer for Think Outside the Tax Box and author of the Josh & Taxes newsletter, which combines his love of tax and technology.

Active in the tax community, Josh serves on the Government Relations committee for the NAEA and is a member of ASTPS, NATP, NYSSEA, CSEA, and the North Texas LGBT Chamber of Commerce. Outside of work, he enjoys family time and traveling.

About our 2026 Sponsors and Exhibitors

Frequently Asked Questions

Q: How many CPE's are the sessions worth for a CPA? Do the Federal Law hours apply?

A: Yes! Since CPA is a national designation, any Federal tax law/federal update/ethics hours DO apply to CPA CPEs. Only the CA-designated hours won't apply as that is for CTEC only.

Q: What handouts are available?

A: Each registrant will receive at check-in a USB thumb drive containing the electronic handouts provided by the speakers in advance. If there are any changes to the handouts, or if a speaker does not submit handouts in advance, after the conclusion of the Symposium an email will be sent containing a link to a CSTC webpage with the final handouts posted. They will not be emailed during the Symposium. Attendees may choose to print sections/pages from the USB on-site at the Symposium using the hotel business center or printer of their choice. Alternatively, you can pre-order a printed copy of all session handouts (as provided in advance by the speakers) in a bound, tabbed book format for $200. Deadline to order is May 30.

Q: What if I want to change a session after I have registered?

A: No problem! CE reporting will be completed based on the in-person sign-in sheets, so attendees are able to change their session onsite.

Q: What is the maximum CPE I can get from the Summer Symposium?

A: An attendee can earn up to 24 total hours by attending the sessions each day. The type of hours will vary depending on the attendee's choice of which courses to attend.

The Symposium presentations have been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

|

Patty Barron, EA

Patty Barron, EA Tom Gorczynski, EA, USTCP

Tom Gorczynski, EA, USTCP Shannon Hall, EA

Shannon Hall, EA Natalie Kolodij, EA, CRETS

Natalie Kolodij, EA, CRETS

Brad Messner, EA

Brad Messner, EA Matt Metras, EA

Matt Metras, EA Jane Ryder, EA, CPA

Jane Ryder, EA, CPA