|

CSTC's 2024 SUMMER TAX SYMPOSIUM

July 21 - 24, 2024

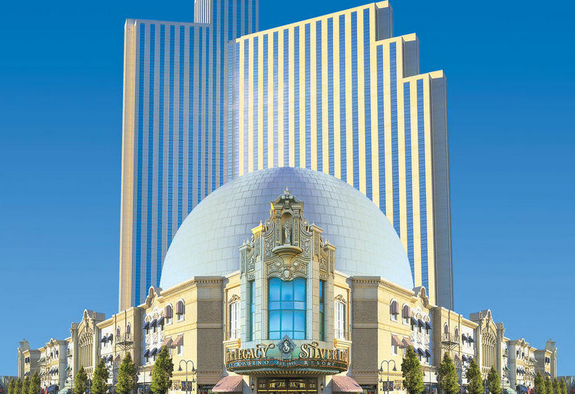

Silver Legacy Resort Casino

Reno, Nevada

The California Society of Tax Consultants, Inc (CSTC), has been a nonprofit organization for the benefit of tax professionals throughout California since 1966 (formerly known as ISTC), and delivers quality education and unique member benefits. As a bookkeeper, accountant, CRTP, Enrolled Agent, or CPA, you can take advantage of everything CSTC has to offer. Programs cover a wide spectrum of tax topics that are approved for CTEC, EA & CPA credit.

Did you know that you can get ALL of your CTEC credits for the year at the Symposium? That’s right! You can get your federal, update, Ethics, and CA hours all in one go!

Oh, and did we mention the return of the Lunch and Learn sessions? Your registration includes breakfast AND lunch each day of the event!

With our fantastic line-up of speakers and topics there’s something for everyone, from beginner to veteran preparers.

Can’t wait to see you in Reno! The CSTC Summer Tax Symposium is an event not to miss!

Quick Links

Summer-Symposium Schedule-at-a-Glance

| |

Sunday, July 21, 2024

|

| 3:00 PM to 5:00 PM |

Registration Open; Exhibitor Set-up |

| 5:00 PM to 6:00 PM |

Welcome Reception for First-Time Attendees |

| 6:00 PM to 7:00 PM |

Welcome Reception (light appetizers will be served)

This event is family-friendly.

(Included with full registration. Guest registration is $95)

|

| |

Monday, July 22, 2024

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

IRS Breakfast Keynote Session

IRS Keynote: IRS Transformation and the Inflation Reduction Act: The IRS Perspective

Speaker: Margaret A. Romaniello, Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division |

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: ERTC: Don't Play the Audit Lottery

Speaker: Ryan Reichert, EA, CFP

|

| |

Track Two: 1031 Exchange Extravaganza

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP, Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”) and Russell Marsan, Senior Vice President, IXP 1031

This session continues after the break until 12 pm.

|

| |

Track Three: Correcting & Reconstructing Partner & S-Corp Basis

Speaker: Jane Ryder, EA, CPA

This session continues after the break until noon.

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: LLC's - To Be or Not To Be

Speaker: Veronica Marelli, EA

|

| |

(CONTINUED) Track Two: 1031 Exchange Extravaganza

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP, Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”) and Russell Marsan, Senior Vice President, IXP 1031

Do not register for this session if you did not select the 9:15 am session.

|

| |

(CONTINUED) Track Three: Correcting & Reconstructing Partner & S-Corp Basis

Speaker: Jane Ryder, EA, CPA

Do not register for this session if you did not select the 9:15 am session.

|

| 12:00 PM to 1:20 PM |

Lunch and Learn: Leveling Up: Transforming Tax Practice Management

Speaker: Demi Woodson, CRTP

|

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: California Collections from Start to Finish

Speaker: Veronica Marelli, EA |

| |

Track Two: How to read a will, a trust, and other estate planning documents

Speaker: Frank Acuna, Attorney at Law |

| |

Track Three: Retirement Plans...Choose Wisely

Speaker: Michael Tullio, EA |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: 2023 & 2024 Individual Tax Update

Speaker: Jane Ryder, EA, CPA |

| 5:00 PM to 6:30 PM |

Reception with Exhibitors |

| |

Tuesday, July 23, 2024

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 7:30 AM to 9:00 AM |

Franchise Tax Board Breakfast Keynote Session

2024 California Tax Updates

Speaker: Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office

|

| 9:15 AM to 10:05 AM |

Breakout Sessions: |

| |

Track One: Disclosing Tax Return Positions

Speaker: Tom Gorczynski, EA, USTCP

|

| |

Track Two: Energy Credits: Packing a Powerful Punch!

Speaker: Ryan Reichert, EA, CFP

This session continues after the break until noon.

|

| |

Track Three: Itemized Deductions - Schedule A

Speaker: Claudia Stanley, CPA, EA

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Tax Planning Strategies for Individuals

Speaker: Tom Gorczynski, EA, USTCP

|

| |

(CONTINUED) Track Two: Energy Credits: Packing a Powerful Punch!

Speaker: Ryan Reichert, EA, CFP

Do not register for this session if you did not select the 9:15 am session.

|

| |

Track Three: Oh, Those Crazy Landlords

Speaker: Michael Tullio, EA

|

| 12:00 PM to 1:20 PM |

2024 Annual Business Meeting and Lunch

(Included with registration) |

| 1:20 PM to 3:00 PM |

Breakout Sessions: |

| |

Track One: Tax Planning Strategies for Rental Property Owners

Speaker: Tom Gorczynski, EA, USTCP

|

| |

Track Two: California Update

Speaker: Claudia Stanley, CPA, EA

|

| |

Track Three: Preparing Form 706 With An Emphasis on Portability

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Business Update

Speaker: Ryan Reichert, EA, CFP |

| |

Wednesday, July 24, 2024

|

| 7:00 AM to 5:00 PM |

Registration and Exhibits |

| 8:20 AM to 10:05 AM |

Breakfast Keynote Session: Stop leaving money on the table. Build A Tax Consulting Practice!

Speaker: Frank Acuna, Attorney at Law

|

| 10:05 AM to 10:20 AM |

Coffee Break / Break with Exhibitors |

| 10:20 AM to 12:00 PM |

Breakout Sessions: |

| |

Track One: Tax Planning for the Silver Tsunami 2.0

Speaker: Rod Couts, EA

|

| |

Track Two: Gambling Tax Issues

Speaker: Tom Gorczynski, EA, USTCP |

| |

Track Three: Unraveling the Mysteries of Clergy Taxes

Speaker: David Eastis, CRTP

|

| 12:00 PM to 1:20 PM |

Lunch and Learn: Death Taxes for CPAs

Speaker: James Cunningham, Partner and CEO |

| 1:20 PM to 3:00 PM |

General Session

Stump the Tax Experts

Speaker: Speakers are invited to join this panel |

| 3:00 PM to 3:20 PM |

Break with Exhibitors |

| 3:20 PM to 5:00 PM |

General Session: Unethical Minds

Speaker: Shannon Hall, EA

|

| 5:15 PM |

Grand Prize Drawing |

Registration Information and Fees

| Category |

Fee by March 15, 2024 |

Fee by April 30, 2024 |

Fee After April 30, 2024 |

| Members |

$649 |

$699 |

$749 |

| Staff of Members |

$674 |

$724 |

$774 |

| Non-Members |

$874 |

$924 |

$974 |

| Sunday Night Reception Guest Tickets (appetizers served) |

$95 |

$95 |

$95 |

Registration fees include: Educational sessions and materials, including a USB thumbdrive of electronic handouts delivered at check-in, daily breakfasts, daily lunches, Sunday evening reception, and refreshment breaks. Registrants will also receive an email with the electronic handouts after the Symposium.

Optional Printed Handouts: $175 for all session handouts (regardless of sessions selected to attend), book-style, bound and tabbed, delivered at check-in.

The deadline to order printed handouts is June 30, 2024. See FAQ's for more details.

Cancellation policy: Written/emailed requests for a registration fee refund will be accepted until June 14, 2024. A $150 administrative fee will be deducted from all refunds. No refund of any kind will be given if a written cancellation notice is received after June 14, 2024. There are no refunds for no-show registrants.

Book Your Room!

Silver Legacy Resort and Casino

407 North Virginia Street

Reno, Nevada 89501

1-800-687-8733

http://www.silverlegacyreno.com/

THE DISCOUNTED HOTEL ROOM RATE IS NO LONGER AVAILABLE. Please book your room via the hotel's main website or call (775) 329-4777.

Check-in time is 3:00 PM and check-out time is noon.

A daily resort fee of $25.00 per room, per night plus the current occupancy room tax will be charged in addition to the room rates set forth above. This fee includes:

• In-room Keurig® coffee maker with Starbucks® K-Cup® Pods

• Unlimited local and toll-free calls

• Refrigerator and in-room safe*

• Airport shuttle service and self-parking

• Access to the all-new Fitness Center inside The Spa at Silver Legacy

• Printing of boarding passes, notary services, and safety deposit box access.

Located in the heart of the Biggest Little City, Silver Legacy Resort Casino offers everything under one roof. This modern Reno hotel has restaurants, big-name entertainment and an action-packed casino. Silver Legacy also has gorgeous mountain views and is a quick drive from Lake Tahoe.

Session Descriptions

IRS Breakfast Keynote Session: IRS Transformation and the Inflation Reduction Act: The IRS Perspective

Speaker: Margaret A. Romaniello, Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division

Session Description: The Inflation Reduction Act (IRA) was signed into law in August 2022, giving the IRS a historic opportunity to transform tax administration and services provided to taxpayers and tax professionals. Shortly after IRA’s enactment, the Department of the Treasury and the IRS developed a Strategic Operating Plan. The Strategic Operating Plan outlines how IRS will deliver transformational change for taxpayers. In this course, learn the status of IRS transformation efforts, including Taxpayer Services, Compliance, Workforce Building, and Information Technology Modernization. Also, find out how IRS Stakeholder Liaison supports the tax professional community through partnering efforts utilizing a staff of local liaisons across the country who help practitioners navigate the IRS.

1 Federal Update hour

IRS: 18QC1-U-01999-24-I

CTEC: 1000-CE-5449

Knowledge Level: Update (Information on new tax laws)

ERTC: Don't Play the Audit Lottery

Speaker: Ryan Reichert, EA, CFP

Session Description: The Employee Retention Tax Credit has been one of the most abused provisions in tax for the last four years. The IRS is ready to throw the book at taxpayers who claimed this credit erroneously. This seminar will examine which taxpayers are at risk, how to withdraw a claim, and how to survive an audit.

Learning Objectives:

#1: Review the requirements and misconceptions for claiming the Employee Retention Tax Credit.

#2: Understand the withdrawal provisions available to taxpayers who claimed this credit erroneously.

#3: Learn the key points of defending your clients in an Employee Retention Tax Credit audit.

1 Federal Law hour

IRS #: 18QC1-T-01947-24-I

CTEC #: 1000-CE-5389

Knowledge Level: Intermediate (Basic knowledge helpful)

1031 Exchange Extravaganza

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP, Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”) and Russell Marsan, Senior Vice President, IXP 1031

Session Description: Our clients are selling real estate with substantial gains and the best way to defer the capital gains tax is through a 1031 exchange. We will review the qualifications of a 1031 exchange and the opportunities of a 1031 exchange. We will also learn how to take advantage of a 1031 exchange to defer the tax on the gain of the sale of a principal residence. We are calling this a 1031 Exchange Extravaganza because there will be three excellent speakers for this session: Larry Pon, CPA, EA will be covering the tax aspects. Jamie Furlong of Legacy Investments will be covering the real estate and DST considerations for 1031 exchanges. Russell Marsan of IPX 1031 Exchange will go over the 1031 exchange mechanics, issues, and timing.

Learning Objectives:

#1: Learn how to defer taxes from the sale of real estate.

#2: Ways to increase your client's income from their real estate investments.

#3: Find out how to make estate planning easier when it comes to distributing real estate to beneficiaries.

3 Federal Law hours

IRS #: 18QC1-T-01934-24-I

CTEC #: 1000-CE-5375

Knowledge Level: Basic (No prior knowledge expected)

Correcting & Reconstructing Partner & S-Corp Basis

Speaker: Jane Ryder, EA, CPA

Session Description: This course reviews accurate reporting, correcting, and reconstructing for partner and S corp shareholder basis. Including two very common matters affecting S corp shareholder and partner basis related to how business ERC refunds and PPP loans were reported on the entity tax returns. These entity reporting errors cause basis to be understated, often by substantial amounts. Individual and business tax preparers should review these and other critical basis miscalculations and identify clients with these issues and how to fix them. See how incoming or exiting shareholders, partners and LLC members' accounts are handled plus basis issues when an entity closes or distributes assets.

Learning Objectives:

#1: Review basis fundamentals for shareholders, partners, & LLC members.

#2: Identify specific partnership & S corp transactions that may cause basis problems. And Learn best practices for correcting or reconstructing basis if needed.

#3: Determine tax practitioners' exposure and responsibilities related to basis.

3 Federal Law hours

IRS #: 18QC1-T-01955-24-I

CTEC #: 1000-CE-5398

Knowledge Level: Basic (No prior knowledge expected)

LLC's - To Be or Not To Be

Speaker: Veronica Marelli, EA

Session Description: How often do you hear, “I’m an LLC!” in response to your question about a client tax situation? More taxpayers are setting up random LLCs for every idea or dream business they have without really understanding the consequences of that decision. As a tax professional, you may need to unravel the tangled mess of an LLC, getting taxpayers back on the right track. We will discuss the legal side & tax ramifications of a taxpayer having an LLC in today’s business climate.

Learning Objectives:

#1: Learn the tax & legal basis for an LLC in most states of the union.

#2: Determine how to help a taxpayer determine the best tax structure for the new or existing LLC. Learn to walk a taxpayer through the pros and cons of the multiple structures to best help a client's overall tax strategy.

#3: Shine as a superior tax professional that you are in the arena of LLC management to multiple clients in the business world. A great topic for the professional wanting to bring on more higher-paying business clients.

2 Federal Law hours

IRS #: 18QC1-T-01935-24-I

CTEC #: 1000-CE-5376

Knowledge level: Intermediate (Basic knowledge helpful)

Lunch and Learn: Leveling Up: Transforming Tax Practice Management

Speaker: Demi Woodson, CRTP

Session Description: Join us for an insightful lunch & learn session where we dive into the secrets of elevating your tax practice. Discover innovative strategies to streamline processes, enhance efficiency, and implement best practices that go beyond the basics. Perfect for tax professionals aiming to optimize their operations and achieve unparalleled success.

No CE offered for this course

California Collections from Start to Finish

Speaker: Veronica Marelli, EA

Session Description: Know what to do the moment a prospective or current client walks in the door with a California tax-due notice. During this presentation, we will discuss step-by-step the best practices & optimal way to manage a CA collections case no matter the dollar amount. Gain confidence to be the best in your office at collection representation with one of the largest collection agencies in the US.

Learning Objectives:

#1: Learn the CA Franchise Tax Board processes for collections & steps to mitigate all collection possibilities. Learn all about CSED & tolling events to better guide clients in resolving their CA debt.

#2: Determine the best practices to assist taxpayers in resolving their CA tax debt in the speediest, least costly way & get them back in compliance.

#3: Know exactly which forms to complete, which supporting documents to send, and how long to expect in the process.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-5377

Knowledge level: Advanced (More experienced)

How to read a will, a trust, and other estate planning documents

Speaker: Frank Acuña, Attorney at Law

Session Description: Tax practitioners are called upon to accurately report income, expense, gains, and losses relating to trusts. But how do you do it if you can’t understand the trust or don’t know where to look?

This class focuses on finding the key information that a tax professional must glean from a will, trust, power of attorney, and other documents to fulfill their ethical and professional duties. Among the topics we will cover:

-Who are the players, and what roles do they play?

-Who “owns” any relevant privileges and the relationship with the tax professional (and other professionals)?

-Who are the beneficiaries, and to what are they entitled (and when)?

-What are principal, income, and distributable net income and how do these concepts impact a trust income tax return?

And many, many more!

This practical, hands-on seminar is taught from the perspective of legal and tax advisors who will be serving trustees of irrevocable trusts and preparing returns.

Learning Objectives:

#1: Identify various common estate planning documents and the reasons they exist.

#2: Learn to identify the “stakeholders” in each document, and to whom disclosures may be made.

#3: Apply trust taxation principles to the documents being reviewed to insure correct reporting and compliance

2 Federal Law hours

IRS #: 18QC1-T-01950-24-I

CTEC #: 1000-CE-5392

Knowledge Level: Basic (No prior knowledge expected)

Retirement Plans...Choose Wisely

Speaker: Mike Tullio, EA

Session Description: A course designed to give an overview of the many retirement plan options. As a tax preparer, you must have a high level of understanding of this topic. Helping to advise tax clients about retirement savings plans may be easier than you think. The biggest problem is the many retirement plans that can provide tax benefits to both employers and employees.

Learning Objectives:

#1: Traditional vs Roth, Individual Retirement Arrangements (IRA) – SIMPLE IRA Plans – Payroll Deduction IRA

#2: Simplified Employee Pension (SEP), 401(k) Plan – Simple 401(k) Plan – Starter 401(k) Plan, 403(b) Tax-Sheltered Annuity Plan

#3: Required Minimum Distribution (RMD)

2 Federal Law hours

IRS #: 18QC1-T-01936-24-I

CTEC #: 1000-CE-5378

Knowledge Level: Basic (No prior knowledge expected)

General Session - 2023 & 2024 Individual Tax Update

Speaker: Jane Ryder, EA, CPA

Session Description: This course reviews federal 2023 individual tax updates and includes any new 2023 tax matters as well as planning for 2024 individual taxes and any new tax guidance or legislation enacted in 2024. Receive up-to-date information on IRS's EITC focus, changes to the Child Tax Credit, Schedule A SALT limitation, and more. We’ll review the new energy credits and vehicle credits for individuals and Schedule E rentals, SECURE Act 2.0, plus the challenges of basis compliance for our partner and S corp shareholder Schedule K-1, Form 1040 clients.

Learning Objectives:

#1: Review 2023 federal tax matters for individuals including late breaking legislation affecting 2023 taxes.

#2: Learn the latest 2024 federal tax guidance or legislation for individuals.

#3: Develop up-to-date 2024 tax planning moves for your individual and rental clients.

2 Federal Update hours

IRS #: 18QC1-U-01956-24-I

CTEC #: 1000-CE-5399

Knowledge Level: Update (Information on new tax laws)

FTB Breakfast Keynote Session: 2024 California Tax Updates

Speaker: Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office

Session Description: Overview of the Taxpayers Advocate Office, Legal Updates, How to best communicate with the Franchise Tax Board

1 California hour

IRS: N/A

CTEC: 1000-CE-5434

Knowledge Level: Basic (No prior knowledge expected)

Disclosing Tax Return Positions

Speaker: Tom Gorczynski, EA, USTCP

Session Description: When living in a world of tax uncertainty, appropriate disclosure of tax return positions can help protect taxpayers. This course will explain when a taxpayer should consider disclosing a tax return position and how to adequately disclose it on the tax return.

Learning Objectives:

#1: The attendee will be able to explain how disclosure affects the assertion of penalties.

#2: The attendee will be able to describe how a taxpayer adequately discloses a tax return position.

#3: The attendee will demonstrate proper completion of Form 8275, Disclosure Statement.

1 Federal Law hour

IRS #: 18QC1-T-01937-24-I

CTEC #: 1000-CE-5379

Knowledge level: Basic (No prior knowledge expected)

Energy Credits: Packing a Powerful Punch!

Speaker: Ryan Reichert, EA, CFP

Session Description: Energy credits have experienced a massive overhaul in the last few years, leaving preparers feeling uneasy when advising their clients. In this seminar, we will restore your confidence in these credits by looking at: -New rules and regulations for electric vehicle credits -The energy-efficient home improvement credit -"Solar credit" for rental properties -A refresher on solar credits for a primary residence -Desktop reference charts to keep all of the rules straight

Learning Objectives:

#1: Learn the new rules for clean vehicle credits.

#2: Understand the grey areas surrounding the residential clean energy credit.

#3: Apply the rules for each type of energy credit and how to report them on the tax return properly.

3 Federal Law hours

IRS #: 18QC1-T-01946-24-I

CTEC #: 1000-CE-5388

Knowledge level: Intermediate (Basic knowledge helpful)

Itemized Deductions - Schedule A

Speaker: Claudia Stanley, CPA, EA

Session Description: The course takes a close look at Schedule A and itemized deductions. What qualifies for medical deductions, state and local taxes, allowable types of interest, rules for charitable donations, and miscellaneous itemized deductions? There will be an emphasis on residential mortgage interest and how to treat various types of borrowing and refinancing scenarios.

Learning Objectives:

#1: Gain an understanding of the mortgage interest deduction rules.

#2: Learn what types of medical costs can and cannot be deducted.

#3: Understanding miscellaneous itemized deduction in a post-TCJA world.

1 Federal Law hour

IRS #: 18QC1-T-01952-24-I

CTEC #: 1000-CE-5394

Knowledge level: Basic (No prior knowledge expected)

Tax Planning Strategies for Individuals

Speaker: Tom Gorczynski, EA, USTCP

Session Description: It is a myth that individual taxpayers with no business or rental activities have no material tax planning opportunities. This course reviews potential tax planning strategies for individual taxpayers who do not own a business or rental activity.

Learning Objectives:

#1: The attendee will be able to explain the requirements for each tax planning strategy discussed.

#2: The attendee will be able to describe barriers to the implementation of each tax planning strategy discussed.

#3: The attendee will be able to calculate the potential tax savings for each tax planning strategy discussed.

2 Federal Law hours

IRS #: 118QC1-T-01938-24-I

CTEC #: 1000-CE-5380

Knowledge Level: Basic (No prior knowledge expected)

Oh, Those Crazy Landlords

Speaker: Mike Tullio, EA

Session Description: This course will cover some of the “Up & Down” that tax preparers must deal with customers that have rental properties. The basic focus will be on Form 1040, Schedule E, Page 1 – Supplemental Income and Loss (From rental real estate) and Form 8825 – Rental Real Estate Income and Expenses of a Partnership or an S Corporation.

Learning Objectives:

#1: What happens when the property is sold (not 1031 Exchanges)

#2: Short-term rentals (Airbnb, VRBO) and Rent-for-Profit

#3: Depreciation, Deductions and Expenses

2 Federal Law hours

IRS #: 18QC1-T-01939-24-I

CTEC #: 1000-CE-5381

Knowledge Level: Basic (No prior knowledge expected)

Tax Planning Strategies for Rental Property Owners

Speaker: Tom Gorczynski, EA, USTCP

Session Description: This course reviews tax planning strategies for individuals who own rental properties. Topics to be reviewed include but are not limited to, strategies for using rental losses, active participation in real estate activities, real estate professional status, the short-term rental "loophole", and cost segregation.

Learning Objectives:

#1: The attendee will be able to explain the requirements for each tax planning strategy discussed.

#2: The attendee will be able to describe barriers to the implementation of each tax planning strategy discussed.

#3: The attendee will be able to calculate the potential tax savings for each tax planning strategy discussed.

2 Federal Law hours

IRS #: 18QC1-T-01940-24-I

CTEC #: 1000-CE-5382

Knowledge level: Intermediate (Basic knowledge helpful)

California Update

Speaker: Claudia Stanley, EA, CPA

Session Description: The course provides the latest information on CA taxation. Topics covered included: California changes impacting 2023 and 2024 returns; new rules, cases, and guidance from the state; as well as the latest on proposed changes from pending California legislation. The course will address both personal and business-related changes.

Learning Objectives:

#1: The latest information impacting 2023 California tax returns on extension.

#2: The latest information on interacting with the Franchise Tax Board.

#3: Changes that may impact your 2024 planning for California taxes.

2 California hours

IRS #: N/A

CTEC #: 1000-CE-5395

Knowledge level: Intermediate (Basic knowledge helpful)

Preparing Form 706 With An Emphasis on Portability

Speaker: Lawrence Pon, CPA/PFS, CFP, EA, USTCP, AEP

Session Description: When our clients pass away, we may need to file Form 706 - Estate Tax Return. This is especially important if your clients were married and the first spouse passed away. We will review the importance of filing for the Portability of the Deceased Spouse Unused Exemption (DSUE). When the Tax Cuts and Jobs Act (TCJA) expires at the end of 2025, there will be substantial changes to the estate basic exclusion so we need to help our clients get prepared for that change. We will also review a case study with a completed Form 706.

Learning Objectives:

#1: Protect our clients from a possible decrease in the Basic Estate Exclusion.

#2: Learn about Portability of the Deceased Spouse Unused Exemption (DSUE).

#3: Learn how to complete Form 706 - Estate Tax Return.

2 Federal Law hours

IRS #: 18QC1-T-01941-24-I

CTEC #: 1000-CE-5383

Knowledge level: Intermediate (Basic knowledge helpful)

General Session - Business Update

Speaker: Ryan Reichert, EA, CFP

Session Description: Every year, there are new changes that impact business taxpayers. This session will cover all of the major changes tax professionals should be aware of when preparing returns and providing tax planning for their clients. The seminar will also cover new information related to the Corporate Transparency Act, its impact on your clients, and whether or not this is a service that tax professionals should offer.

Learning Objectives:

#1: Review major changes tax professionals should be aware of when preparing extended 2023 returns.

#2: Discover tax planning opportunities for the 2024 tax year.

#3: Address concerns and reporting related to the Corporate Transparency Act (Beneficial Ownership Information Reporting).

2 Federal Update hours

IRS #: 18QC1-U-01948-24-I

CTEC #: 1000-CE-5390

Knowledge level: Update (Information on new tax laws)

Breakfast Keynote Session - Stop leaving money on the table. Build A Tax Consulting Practice!

Speaker: Frank Acuña, Attorney at Law

Course Description: I hear it from tax professionals:

My tax practice is shrinking as my clients are retiring!

It’s “boom or bust”. Cash flow during tax season, then nothing!

I hear it from my clients:

-How can I pay less tax next year?

-What’s the deal with retirement accounts? In fact, will I be able to retire, and when?

-How will my sources of income affect my retirement budget and my expected tax burden?

-I have a home, rental property, etc. What is going to happen to my kids when they inherit?

-I want to start gifting to my kids. What’s the best way to do it?

-I need a loan. What are they asking for?

-My mom needs skilled nursing or Medi-Cal. Will they qualify? How can I make them eligible?

The answer for both tax professionals and clients is to think outside of the box and expand the services you provide. There is no lack of software or competitors to help our clients with doing their taxes, particularly after retirement. But clients want and need more. They need solid tax, financial, and budgeting advice and they are willing to pay for it!

Be ready to brainstorm, dream, plan, and create a tax, financial, and budgeting practice that will add to your bottom line and will make you stand out in a crowd of tax compliance alternatives!

Learning Objectives:

#1: Identify the areas of tax planning for which clients are clamoring for help

#2: Learn the basics of each of these areas, and identify further knowledge, training, and experience needed to consult with clients in each of them

#3: Develop marketing statements and a marketing calendar for tax consulting.

2 Federal Law hours

IRS #: 18QC1-T-01951-24-I

CTEC #: 1000-CE-5393

Knowledge level: Basic (No prior knowledge expected)

Tax Planning for the Silver Tsunami 2.0

Speaker: Rod Couts, EA

Session Description: The Secure Act 2.0 has changed the retirement planning landscape. Understanding these changes and more will enhance your role as a tax advisor in helping your clients make key decisions that will greatly impact their financial future. During this session, you will learn advanced concepts for answering more of your clients' Social Security questions, tax planning for pensions and annuities, strategies for IRA to Roth conversions, IRA law updates, Health Savings accounts as retirement tools, and options for using 529 plans to fund retirement. We will also take a deeper dive into the Secure Act 2.0 and review what is on the horizon on laws affecting retirement plans. Retirement planning is essential for being an effective tax advisor. This class will elevate your skills to be the effective advisor your clients expect of you.

Learning Objectives:

#1: How to explain to clients how Social Security works and strategies for maximizing the benefit.

#2: How to advise clients on the impact, benefits, and pitfalls of IRA to Roth conversions.

#3: Develop a plan for advising your clients on retirement planning strategies centered around tax planning.

2 Federal Law hours

IRS #: 18QC1-T-01942-24-I

CTEC #: 1000-CE-5384

Knowledge level: Basic (No prior knowledge expected)

Gambling Tax Issues

Speaker: Tom Gorczynski, EA, USTCP

Session Description: The incorrect reporting of wagering gains and losses is common. This course will review the taxation of casual gambling activities as well as tax issues faced by professional gamblers. How to advise clients on proper documentation and tracking of gambling activities will be discussed.

Learning Objectives:

#1: The attendee will learn how to calculate gambling gains and losses per session based on existing law.

#2: The attendee will be able to explain how and to what extent a taxpayer can deduct gambling losses.

#3: The attendee will be able to describe the documentation needed to calculate gambling gains and losses.

2 Federal Tax Law hours

IRS #: 18QC1-T-01943-24-I

CTEC #: 1000-CE-5385

Knowledge level: Basic (No prior knowledge expected)

Unraveling the Mysteries of Clergy Taxes

Speaker: David Eastis, CRTP

Session Description: There are unique challenges and rules in preparing a tax return for Clergy/Pastors. We will explore Pub 157 (Guidelines for Ministers). This includes tax information for the following classes of taxpayers:

•Ministers

•Members of a religious order

•Christian Science practitioners and readers

•Religious workers (church employees), and

•Leaders of a recognized religious sect

As a result, we will gain a deeper understanding of the resources needed to address tax issues facing Clergy/Ministers.

We will explore

•sources of income and fringe benefits

•wages

•self-employed income

•tax-exempt allowances (housing)

The goal of this workshop is to help the attendees develop new resource tools for determining and understanding the tax issues for completing Clergy tax returns.

Learning Objectives:

#1: Exploring the format of pub 157 (guidelines for ministers)

#2: Develop a resource tool for determining sources of income, fringe benefits, wages, self-employed income, and tax-exempt allowances (housing).

#3: Completing a case study federal tax return for Clergy.

2 Federal Law hours

IRS #: 18QC1-T-01944-24-I

CTEC #: 1000-CE-5386

Knowledge Level: Basic (No prior knowledge expected)

Lunch and Learn: Death Taxes for CPAs

Speaker: James Cunningham, Partner and CEO

Session Description: The federal estate tax exemption is at a historic high but soon will be cut in half. In 2024, the federal estate tax rate is an enormous 40% if you have over $13.61 million in total assets as an individual. However, in 2025, the exemption will drop back to $5 million, adjusted for inflation. These numbers may sound like a lot but remember that ALL property is included in the calculation, and the thresholds are always subject to change in the political winds. This means not just cash and investments but also real estate, business interests, and other assets. We will provide a comprehensive overview of the tax, explaining how it works, who it impacts, and its implications for estate planning. We will also look at five top strategies to avoid death taxes.

No CE offered for this course

General Session - Stump the Tax Experts

Speaker: All speakers are invited to join this panel

Session Description: This is a special question-and-answer session with our unique panel of Tax Experts that includes many of our terrific speakers who have agreed to let us test their tax knowledge! Do you have a burning question that is driving you crazy because you cannot find the answer on your own? Did you learn something in one of your classes that needs further explanation for you to understand the tax concept? Questions will be collected during the Symposium.

2 Federal Law hours

IRS #: 18QC1-T-01949-24-I

CTEC #: 1000-CE-5391

Knowledge level: Basic (No prior knowledge expected)

General Session - Unethical Minds

Speaker: Shannon Hall, EA

Session Description: They’re lurking all around us, sometimes hiding in plain sight. You never know who around might be an UNSUB (Unethical Subject). Join the UBAU (Unethical Behavior Analysis Unit) as we profile some of the most egregious ethics violations and explore the pitfalls that can lead otherwise ethical preparers astray. Together we will unearth the truth about the history of tax preparer ethics and the events that led us to this classroom today. We will explore the evolution of ethical guidelines and how they are applied and enforced. We will dive deep into the most outrageous cases of unethical behavior, including the latest in predatory practices, and due diligence requirements.

Learning Objectives:

#1: Outline penalties and other punitive actions related to ethical violations.

#2: Identify ethical violations and explore ways to handle situations ethically.

#3: Gain a clear understanding of the requirements for due diligence.

2 Ethics hours

IRS #: 18QC1-E-01945-24-I

CTEC #: 1000-CE-5387

Knowledge level: Basic (No prior knowledge expected)

About the Presenters

Frank Acuña, Attorney at Law Frank Acuña, Attorney at Law

Frank R. Acuña is a founding partner of ACUÑA ❖ REGLI. He is a California State Bar-certified estate planning, trust, and probate law specialist. His practice includes estate planning; inheritance litigation; business succession planning; special needs trusts; and farm, ranch, and vineyard succession planning. Mr. Acuña has taught tax seminars for the National Tax Practice Institute, the California Society of Enrolled Agents, the California Society of Tax Consultants, a number of state and local chapters of the National Association of Enrolled Agents, and the American Institute of Certified Public Accounts. Mr. Acuña also is a featured speaker for the Professional Fiduciary Association of California, the National Guardianship Association, and the California Public Administrators, Public Conservators, and Public Guardians. He advises tax, fiduciary, and real estate professionals throughout the State of California.

Rodney Couts, EA Rodney Couts, EA

Rodney J. Couts, EA (Rod), is the President of Seaside Resources, Inc., located in Carlsbad, CA.

Rod began his tax preparation career in 1987 and achieved the status of Enrolled Agent in March 2005. His practice specializes in serving small businesses, particularly S corporations, as well as high-net-worth individuals.

Rod is a member of the Practice Forward Academy and has effectively transitioned his practice to include advisory services. He collaborates closely with a network of financial advisors to develop comprehensive long-term financial planning strategies for their mutual clients.

Since 2011, Rod has been sharing his expertise by teaching other tax professionals. He has presented classes for the California Society of Tax Consultants (CSTC), the California Society of Enrolled Agents (CSEA), and the National Association of Tax Professionals (NATP). His leadership roles include serving as president of the North San Diego County Chapter of CSTC from 2015 to 2016 and president of CSTC from 2017 to 2019. In recognition of his contributions, he was honored as CSTC Member of the Year in 2015.

Originally from Ohio, Rod earned his Bachelor of Science in Business with a major in accounting from Wright State University in Dayton, Ohio.

Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office

Anna Cowperthwaite has been with Franchise Tax Board (FTB) for 18 years. Prior to joining the Taxpayers' Rights Advocate's Office, Anna worked in the Criminal Investigations Bureau as a Forensic Auditor conducting more complex technical examinations of seized individual, business and bank records to reconstruct income and compute tax liabilities to the standard of proof required for criminal tax prosecutions. Anna also has experience with sourcing and residency issues. Anna is a graduate of Sacramento State University with a Bachelor of Science Degree in Business Administration, with an emphasis in Accounting.

James L. Cunningham, Jr., Partner, Certified Specialist – Estate, Trust, and Probate Law at CunninghamLegalJim Cunningham is a second-generation California attorney in his third decade of practice. Jim and the firm he founded have helped thousands of families and individuals plan their estates—and preserve their legacies. Certified by the State Bar of California’s Board of Specialization as a Specialist in Estate Planning, Trust, and Probate Law, Jim holds a Bachelor of Arts in History from the University of California at Santa Cruz (Honors in the Major) and a Juris Doctor from Whittier College of Law. James L. Cunningham, Jr., Partner, Certified Specialist – Estate, Trust, and Probate Law at CunninghamLegalJim Cunningham is a second-generation California attorney in his third decade of practice. Jim and the firm he founded have helped thousands of families and individuals plan their estates—and preserve their legacies. Certified by the State Bar of California’s Board of Specialization as a Specialist in Estate Planning, Trust, and Probate Law, Jim holds a Bachelor of Arts in History from the University of California at Santa Cruz (Honors in the Major) and a Juris Doctor from Whittier College of Law.

Jim is also a real estate investor, California real estate broker, and recognized expert on California property taxation.

Jim is the best-selling author of Savvy Estate Planning, a book that takes the complex topics of living trusts, wills, probate, estate planning, and estate administration and puts them into simple, easy-to-understand language anyone can understand.

As a third-generation pilot, he says he’s the only one of the pilots in his family never to have crashed a plane–certainly an important distinction.

David A. Eastis, CRTP, BA, MA David A. Eastis, CRTP, BA, MA

Mr. Eastis holds various degrees. His BA is in the area of accounting from Indiana University, South Bend. Other degrees held are from the University of La Verne and Bethany Theological Seminary. David currently has a practice located in Brea, California. One of his specialties is dealing with Non-Profit Corporations. As an active member of CSTC, he has held numerous positions of leadership including state president of CSTC and positions within individual chapters. David is a frequent speaker at the annual CSTC Summer Symposium. David has been an annual speaker in our own Greater Long Beach Chapter sharing his expertise on numerous topics.

Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”) Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”)

Jamie Furlong is the Managing Partner of Legacy Investments & Real Estate, LLC. The inception of Legacy was to address the unique challenges faced by retiring farmers: As the burden of significant capital gains taxes loomed large upon the sale of their farmlands, these professionals found themselves in search of a tax-efficient exit strategy. The 1031 exchange offered a glimmer of hope, but the complexity and limited availability of like-kind exchange properties posed significant challenges. Legacy stepped up to fill a critical gap in the market by offering retiring real estate investors well vetted, high quality, and passive or relatively passive replacement property options through Triple Net and Delaware Statutory Trust investments. They have since become the trusted partner of retiring farmers, retiring landlords and their advisors who seek the most current planning opportunities created by evolving tax legislation. To date, Jamie has been involved in over one hundred 1031 exchange transactions and has helped her clients defer taxes on over $60million of equity.

As a securities-licensed financial professional, Jamie recommends strategies with client goals, objectives, and risk tolerance in mind, ensuring investors preserve their wealth for generations to come. Jamie regularly speaks to commercial and residential real estate groups, estate planning councils, and tax professional associations. As a candidate for the CCIM (Certified Commercial Investment Member) designation, Jamie's commitment to continuing education and industry advancement underscores her dedication to excellence in serving her clients.

Jamie Furlong is a graduate of the University of Southern California where she studied on a scholarship and earned a Bachelor of Science in Mathematics and Economics.

Jamie is a member of her local Rotary Club where she serves on the club’s board of directors and is a director of their foundation. She is passionate about international service and is currently co-chairing an $1,000,000 clean water project in Honduras.

Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Legacy Investments & Real Estate, LLC is independent of CIS and CSTC. This is informational purposes only and does not constitute an offer to purchase or sell securitized real estate investments.

Tom Gorczynski, EA, USTCP Tom Gorczynski, EA, USTCP

Thomas A. Gorczynski, EA, USTCP is a nationally recognized speaker and educator on federal tax law matters. He is the author of the Tom Talks Taxes newsletter, the co-author of the PassKey Learning Systems EA Review Series, and co-owner of Compass Tax Educators. He is an Enrolled Agent, a Certified Tax Planner, a National Tax Practice Institute Fellow, and admitted to the bar of the United States Tax Court as a non-attorney.

Shannon Hall, EA Shannon Hall, EA

Shannon Hall, EA, is a tax professional based in Long Beach, CA. Her diverse client base keeps her on the cutting edge of new tax developments. Shannon is a featured speaker for tax societies nationwide and a writer and presenter for Brass Tax Presentations. She holds degrees in both Accounting and Theatre Arts, which aids her in creating captivating and informative tax presentations.

She has served as the First Vice President of CSTC in charge of education for three years, as well as participating on the board of her local chapter in Orange County. Shannon was named CSTC Member of the Year for 2023.

Veronica Marelli, EA

Veronica has a formal education in Accounting and has been an Enrolled Agent for almost 20 years. She is the owner of Tax Resolution Advocates with offices in Temecula California, SLC Utah, and Southern Idaho. Tax Resolution Advocates is a full-service tax firm that specializes in tax problem resolution. She is also a Certified Tax Resolution Specialist.

She has recently added Profit First consulting to her firm. She is approximately one of only 140 tax professionals in the US to become a Profit First Professional. Profit First is an organization dedicated to eradicating entrepreneurial poverty.

Veronica served as 1st Vice President of the California Society of Tax Consultants at the State level. She also served the local North San Diego Chapter as second Vice President for many years. Both of these positions were as the Education Chair. It was her main responsibility to ensure Tax professionals Statewide were trained and up to date on all new State and federal tax laws and changes to the current tax code.

Veronica has a vast amount of experience serving and working on the Board of Directors. She has, or is currently serving on five different boards of Not-for-profit organizations. These organizations have helped our communities by providing shelter for abused women and homeless teenagers, feeding underprivileged children, and the planting of new Christian Churches.

Russell Marsan, Senior Vice President, IXP 1031 Russell Marsan, Senior Vice President, IXP 1031

With over 27 years experience in the 1031 Exchange industry, Russell Marsan believes that advanced client education is the key to success. He is an accomplished award winning public speaker and has traveled extensively throughout the United States giving over 1,000 entertaining seminars and lectures to attorneys, CPAs, Realtors, commercial brokers, and investors on the subject of 1031 tax deferred exchanges. Russell has the unique ability to break down complex, in-depth issues such as 1031 Exchange rules and regulations into an entertaining presentation everyone can understand and relate to. Russell’s humorous speaking style also helps to make an otherwise dry and boring topic anything but. Russell covers Northern California, Northern Nevada and the states of Montana and Idaho for IPX1031.

IPX1031 Exchange Seminars

IPX1031 provides seminars for continuing education credits as well as custom and personalized seminars on tax deferred exchange topics for attorneys, CPAs, advisors, brokers, REALTORS®, agents, escrow, investors and taxpayers. To find out about a seminar nearest you, or to schedule a seminar for your office, please contact me.

Lawrence Pon, CPA/PFS, CFPR, EA, USTCP, AEP Lawrence Pon, CPA/PFS, CFPR, EA, USTCP, AEP

Mr. Pon is a Certified Public Accountant, Personal Financial Specialist, Certified Financial Planner, Enrolled Agent, United States Tax Court Practitioner, and Accredited Estate Planner in Redwood Shores, CA.

Mr. Pon has been in practice since 1986 and enjoys helping his clients reach their financial goals. He frequently speaks on tax and financial planning topics.

Mr. Pon received his BS in Business Administration with emphases in Accounting and Finance from the University of California, Berkeley, and MS in Taxation from Golden Gate University in San Francisco.

Ryan Reichert, EA, CFP

Ryan Reichert is an Enrolled Agent and Certified Financial Planner practicing in Coronado, California. Don’t let his young looks fool you; when it comes to tax, there are few as enthusiastic as him. Ryan spends his days reading tax law and speaking with the most brilliant tax minds across the country -- all to distill the law down into working concepts you can apply in your practice. His dynamic seminars help attendees stay engaged while he goes beyond the law to show you things you may not have thought possible.

Ryan is out on the road for most of the year teaching for his education organization, Brass Tax Presentations, but he is also a firm believer in practicing what he preaches. His niche focuses on businesses and their owners to ensure maximum tax efficiency. Ryan also provides consulting services to tax professionals all over the country on specialized issues, including the Employee Retention Credit.

Margaret “Maggie” Romaniello is an Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division. Margaret “Maggie” Romaniello is an Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division.

Maggie began her IRS career in January 1991 and trained as a Revenue Officer in Hartford, and Wethersfield, Connecticut before becoming an Insolvency and Technical Advisor for the Special Procedures Function in the Headquarters office in Hartford, CT.

Maggie became a Senior Tax Specialist in Taxpayer Education and Communication and later a Senior Stakeholder Liaison in SL. She then became interested in management and acted as an Insolvency Group Manager for the Connecticut and Albany, and Utica, New York Areas for the Advisory & Insolvency Division of Collection before returning to Stakeholder Liaison.

In addition to participating in the Frontline Leader Readiness Program (FLRP), she served 10+ years as a frontline manager in Stakeholder Liaison, before transitioning to her current position.

Maggie is a graduate of Trinity College in Hartford, Connecticut, where she received a Bachelor of Arts degree, with a major in Italian and holds a Master’s in Business Administration from Rensselaer at Hartford. She lives on a farm in the village of Amston, CT, with her husband, twin sons, dog, two cats, and a variety of feathered friends.

Jane Ryder, EA, CPA Jane Ryder, EA, CPA

Jane Ryder, EA, CPA has been providing tax preparation, accounting services, and tax collection resolution services since 1980. She runs her San Diego CPA firm and writes and speaks on many income tax, business compliance, and accounting topics. Jane has a business-centric practice, preparing and consulting on tax, accounting, and compliance matters for Corporations, S-corporations, LLCs, Partnerships, and Trusts. She also specializes in IRS and state agencies' collection problems, payment plans, audit representation, audit appeals, offers in compromise, and other compliance-related issues. She earned a BS in Business Administration (Accounting) from SDSU and is currently licensed with the California State Board of Accountancy and admitted to practice before the Internal Revenue Service as an Enrolled Agent.

Claudia Stanley, CPA, EA Claudia Stanley, CPA, EA

Claudia Stanley, CPA is a graduate of California State University, Fresno, and serves as treasurer of the California Society of Tax Consultants, as education chair of the Central California Chapter of Enrolled Agents, and as treasurer of Fresno’s local chapter of American Business Women’s Association. Claudia is a long-time member of CSTC. In 2016 she was named member of the year of the Central Valley Chapter of CSTC and in 2001 she was named one of the Top Ten Women of the Year in the nation by the American Business Women’s Association. She frequently speaks on various tax topics.

Michael Tullio, EA Michael Tullio, EA

Mike is an Enrolled Agent and has been in the tax preparation business for nearly 40 years. He is the owner of Michael A. Tullio Financial Services, located on Mission Gorge Road in San Diego California. Mike up until recently was a Senior Tax Content Analyst at Intuit, makers of Turbo Tax, ProSeries, and Lacerte. He is an Enrolled Agent. He is a member of the National Society of Tax Preparers (NSTP) and a member of the California Society Tax Consultants (CSTC).

Demi Woodson, CRTP Demi Woodson, CRTP

Demi Woodson is a seasoned Coach, Practice Management expert, and the founder of Beyond 415 Tax Coaching. With over three decades of tax experience, she has played a pivotal role in building, managing and expanding her family's 48-year-old thriving tax business.

Demi’s firm specializes in handling complex tax returns, including trust and estate returns. Her firm is renowned for its proficiency in navigating intricate tax matters, ensuring clients receive top-tier service.

Demi's passion for supporting and educating tax professionals led her to create the Tax Preparer Support Group, a vibrant community where over 11,000 like-minded tax experts provide invaluable guidance and camaraderie. Her hands-on approach to group moderation ensures a nurturing environment where knowledge thrives.

Recognizing a gap in tax preparer education, Demi started coaching tax professionals in 2019. This pioneering program equips tax professionals with the strategies, operations, and insights needed to build, grow, and scale their successful tax practices.

In addition to her coaching endeavors, Demi introduced groundbreaking initiatives. The Beyond 415 National Tax Summit, a flagship multi-day event, brings tax professionals together to explore the most sought-after topics in tax law, business development, and tools for business expansion. This unique tax conference is now hosted annually in multiple states nationwide.

Demi's recent innovations include the Summit at Sea, an immersive and transformative experience focusing on business and personal development. She also offers Powerup One-Day Bootcamps, Practice Management Master Classes (available as self-study or immersive 3-day in-person workshops), and access to her thriving Facebook group. Her commitment to ongoing education shines through a plethora of live and on-demand webinars, providing valuable CE credits and addressing pivotal practice management topics.

Amidst her professional accomplishments, Demi cherishes quality time with her son, John, and their rescue dog, Boomer. She remains dedicated to serving her current tax clients and team while nurturing the Beyond 415 family, empowering them to envision and create the life and practice they desire, transcending the constraints of tax season.

About our 2024 Sponsors and Exhibitors

SILVER SPONSOR & EXHIBITOR

Accounting & Tax Brokerage is a comprehensive Business Brokerage firm exclusively working with the accounting and tax industry. Whether you're looking to expand or retire, we can help. Visit us at www.ATBCAL.com or call us at (855) 428-2225. ATB, Inc. CA DRE 02002824

EXHIBITORS

Brass Tax is a leading provider of in-person continuing education in the state of California. We provide practical insights on the ever changing tax landscape and help practitioners experience a newfound level of confidence when working with clients.

Tax News & Tips is a white label, client-facing newsletter that covers tax topics your clients need to know about. This service provides tax professionals the ability to stay at the forefront of their clients’ minds without the hassle of having to write, proof, and mail out relevant, accurate, and meaningful tax updates and information.

Beyond 415 Tax Coaching, your ultimate partner in success for tax professionals. With a wealth of expertise spanning over 30 years, we provide a comprehensive suite of transformative programs tailored to elevate your practice to new heights. We offer high-level coaching programs, masterclasses, live events and webinars covering the latest developments in tax law and business strategies to help you unlock the full potential of your practice. Embrace the power of our supportive community, expert-led trainings, and invaluable resources, and embark on a transformative journey towards sustained success in the ever-evolving tax landscape.

Cunningham Legal’s attorneys are experts in the areas of California estate planning, trust administration, real estate law, advanced tax planning for high net-worth families, business law, probate, disability/special needs planning, asset protection, and much more.

IRS Careers

The IRS Stakeholder Liaisons collaborate with stakeholder organizations to provide tax education and just-in-time information, guidance and other resources. Liaisons present at events throughout the country, including the IRS National Webinars Program, and conduct practitioner liaison meetings, small business and multilingual forums to share information on IRS policies, procedures and programs, gather feedback and respond to concerns. Stakeholder Liaisons focus on issues, solicit feedback, and navigate the IRS for tax professionals.

The Taxpayer Advocate Service is an independent organization within the Internal Revenue Service (IRS) that helps taxpayers and protects taxpayer rights. We can offer you free help if your tax problem is causing a financial difficulty, if you’ve tried and been unable to resolve your issue with the IRS, or if you believe an IRS system, process, or procedure just isn't working as it should.

King Financial is a boutique Registered Investment Advisory firm. We specialize in tax-saving investments for business owner clients. We can help save our typical client over $100,000 on taxes. We help your clients keep more of what they have earned. Our main areas of expertise are 401k and Pension Plans, 1031 Exchanges into DSTs Qualified Opportunity Zones, and Family Wealth Management $10,000,000 min.

Legacy Investments & Real Estate provides investors with the potential for all the benefits of real estate investing without the headaches of property management. Armed with a deep understanding of our clients’ unique needs and goals, we customize passive real estate investment plans that align with the legacy they want to build.

Frequently Asked Questions

Q: How many CPE's are the sessions worth for a CPA? Do the Federal Law hours apply?

A: Yes! Since CPA is a national designation, any Federal tax law/federal update/ethics hours DO apply to CPA CPEs. Only the CA-designated hours won't apply as that is for CTEC only.

Q: What handouts are available?

A: Each registrant will receive at check-in a USB thumb drive containing the electronic handouts provided by the speakers in advance. If there are any changes to the handouts, or if a speaker does not submit handouts in advance, after the conclusion of the Symposium an email will be sent containing a link to a CSTC webpage with the final handouts posted. They will not be emailed during the Symposium. Attendees may choose to print sections/pages from the USB on-site at the Symposium using the hotel business center or printer of their choice. Alternatively, you can pre-order a printed copy of all session handouts (as provided in advance by the speakers) in a bound, tabbed book format for $175. Deadline to order is June 30.

Q: Several of the Breakout session tracks are in parts- Can I attend part 2 if I didn't attend part 1?

A: If you want to earn continuing education hours for the session, you must attend both parts 1 and 2. If not, you are welcome to sit in on any session for informational purposes only.

Q: What is the maximum CPE I can get from the Summer Symposium?

A: An attendee can earn up to 24 total hours by attending the sessions each day. The type of hours will vary depending on the attendee's choice of which courses to attend.

The Symposium presentations have been designed to meet the requirements of the Return Preparer Office, the California State Board of Accountancy; and the California Tax Education Council including code 31 of Federal Regulations10.6 (g). This does not constitute an endorsement by these groups. A listing of additional requirements to renew tax preparer registration may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA. 95812- 2890, or phone CTEC at (877) 850-2832, or on the Internet at www.ctec.org.

|

James L. Cunningham, Jr., Partner, Certified Specialist – Estate, Trust, and Probate Law at CunninghamLegal

James L. Cunningham, Jr., Partner, Certified Specialist – Estate, Trust, and Probate Law at CunninghamLegal

Rodney Couts, EA

Rodney Couts, EA Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office

Anna Cowperthwaite, Assistant Technical Advisor to the Advocate, Taxpayers' Rights Advocate's Office David A. Eastis, CRTP, BA, MA

David A. Eastis, CRTP, BA, MA Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”)

Jamie Furlong, Managing Partner, Legacy Investments & Real Estate, LLC (“Legacy”) Tom Gorczynski, EA, USTCP

Tom Gorczynski, EA, USTCP

Russell Marsan, Senior Vice President, IXP 1031

Russell Marsan, Senior Vice President, IXP 1031 Lawrence Pon, CPA/PFS, CFPR, EA, USTCP, AEP

Lawrence Pon, CPA/PFS, CFPR, EA, USTCP, AEP

Margaret “Maggie” Romaniello is an Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division.

Margaret “Maggie” Romaniello is an Advisor to the Director of Stakeholder Liaison (SL) within the IRS Communications & Liaison Division. Jane Ryder, EA, CPA

Jane Ryder, EA, CPA Claudia Stanley, CPA, EA

Claudia Stanley, CPA, EA Michael Tullio, EA

Michael Tullio, EA Demi Woodson, CRTP

Demi Woodson, CRTP